If you’re even a little bit serious about your money, you’ve probably got a spreadsheet. You know the one. It might have started simple, just tracking income and a few bills. But over time, it grew. It became a monster. A beautiful, color-coded, formula-heavy monster that you’re secretly proud of but also terrified to break.

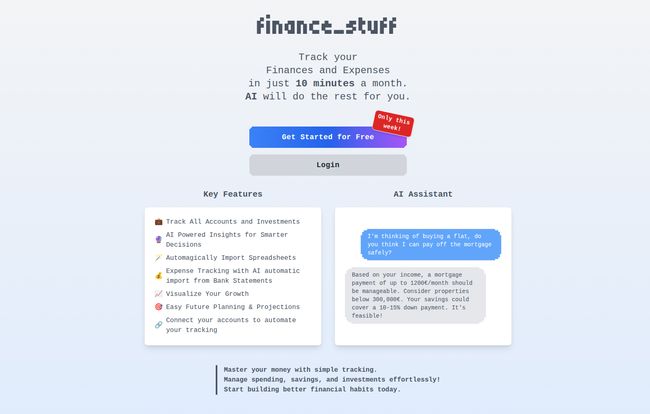

I’ve been there. My own personal finance sheet has more tabs than a web browser during a research deep-dive. It works, sure, but it’s a time sink. And every month, the ritual is the same: download statements, manually enter data, fix that one formula that mysteriously broke. Again. So when I see a tool that promises to track my finances and expenses in just 10 minutes a month, my ears perk up. That tool is called finance_stuff, and it’s leaning heavily on AI to make that bold promise a reality.

So, What Exactly is finance_stuff?

At its core, finance_stuff is a personal finance tracker. But that’s like calling a smartphone a device that makes calls. It’s technically true, but misses the whole point. The platform aims to be an all-in-one dashboard for your entire financial life: your bank accounts, your investments, your spending habits, and your future goals. The secret sauce? It uses artificial intelligence to automate the grunt work and provide insights that your homemade spreadsheet probably can't.

Think of it as having a super-smart financial assistant who doesn't judge you for that third coffee you bought yesterday. It’s designed to be simpler, more intuitive, and honestly, a lot prettier to look at than rows and rows of Arial font.

Finally Ditching the Spreadsheet for Something Smarter

One thing that immediately caught my eye was the creator's story. Alex Manzella, a software engineer with some serious street cred from working at European fintech darlings like N26 and Adyen, basically built this because he was in the same boat as us. He admits to “over-engineering” his personal finance spreadsheet for years before deciding to turn it into a proper app. I feel that in my bones. It’s a classic developer origin story, and it tells me the product is born from a genuine need, not a boardroom brainstorming session.

The platform’s promise to automagically import spreadsheets is a brilliant first step. It’s a bridge for all of us who have years of historical data we don't want to lose. The idea is to get you set up without the headache of starting from scratch. That's a huge barrier to entry for any new finance app, and they seem to get it.

The AI Magic Behind the Curtain

This is where things get interesting. The term 'AI' gets thrown around a lot these days, sometimes for things that are just fancy algorithms. But finance_stuff seems to be integrating it in some genuinely helpful ways.

AI-Powered Insights and Future Projections

The platform features an AI Assistant. From the looks of it, you can ask it some pretty complex questions in plain English, like, “I’m thinking of buying a flat, do you think I can pay off the mortgage safely?” It then crunches your numbers—your income, savings, investments—and gives you a data-backed answer. This moves beyond simple tracking and into actual financial planning. It’s like turning your financial data from a history book into a crystal ball, helping you visualize growth and make smarter decisions for the future. I'm a little skeptical but mostly excited about this feature.

Visit finance_stuff

Automated Tracking and Imports

The long-term vision is clear: total automation. While they’re starting with spreadsheet imports, the “Coming Soon” list includes automatic expense tracking directly from bank statements. This is the holy grail for personal finance apps. When this feature lands, it will be the real test of that “10 minutes a month” claim. For now, the spreadsheet import is a solid, if temporary, solution.

A Quick Word on Security and Trust

Okay, let’s address the elephant in the room. Connecting your financial accounts to a third-party app can feel… sketchy. It requires a leap of faith. finance_stuff seems to understand this hesitation. They explicitly mention that sensitive data is encrypted in their database. More importantly, they offer an anonymous user version. This lets you kick the tires and test it out without handing over your personal info. I think this is a really smart move. It shows confidence in their product and respect for user privacy.

What’s on the Horizon and What’s Missing

finance_stuff is clearly a work in progress, and they’re transparent about it. The “Coming Soon” section is basically a public roadmap, and it’s packed with the good stuff:

- Mobile Apps: A must-have for tracking on the go.

- Budgeting Tools: Essential for proactive financial management.

- More Connectors: Support for more banks and investment platforms is crucial.

- Better Loan Support: For mortgages and other debt.

What's also missing for now is any clear information on pricing. The site says "Get Started For Free" and has a little "Help this grow" tag, which suggests it might be in a free beta period. This is great for early adopters, but it's something to keep in mind for the long term. Will it be a subscription? A one-time fee? Your guess is as good as mine.

Potential Roadblocks to Consider

No tool is perfect, especially a new one. While I’m optimistic, there are a few things to be aware of. The biggest one is putting your trust in the AI's accuracy. For big life decisions, you’ll probably still want to double-check the math yourself. Then there are the potential security jitters I mentioned earlier, which are always a factor in fintech. And of course, many of the most exciting features are still on the ‘coming soon’ list. You’d be signing up for the potential of what it will be, not just what it is today. Its a tradeoff, for sure.

My Final Take on finance_stuff

So, is finance_stuff the one? It’s too early to crown it the undisputed king, but I am seriously impressed with the vision. It’s built by someone who understands the problem space intimately, and it’s focused on solving the biggest pain points of personal finance: manual data entry and a lack of clear, forward-looking insights.

If you're a data-driven person who loves the idea of a perfect financial overview but hates the monthly upkeep of a complex spreadsheet, this tool is aimed directly at you. It feels like the natural evolution of personal finance management. I, for one, will be keeping a very close eye on it. I’ve already signed up for the free version to play around. Why not? It might just free up a few hours of my life every month. And what’s that worth?

Frequently Asked Questions

Is finance_stuff safe to use with my bank accounts?

The platform states that all sensitive data is encrypted. They also offer an anonymous mode so you can try the tool without connecting any personal data, which is a great way to test its features first.

Can finance_stuff really replace my budgeting spreadsheet?

That's the goal! With its ability to import existing spreadsheets and planned features for automatic bank imports and budgeting, it's designed to be a more powerful and less time-consuming alternative. You might want to run them in parallel for a bit to build trust.

How much does finance_stuff cost?

Currently, there is no pricing information available on the website. It appears to be in a free beta or early access phase, so you can get started for free for now.

Who is behind finance_stuff?

It was created by Alex Manzella, a software engineer with extensive experience in the financial technology sector, having worked for major companies like N26 and Adyen.

Does it have a mobile app?

Not yet, but mobile apps for both iOS and Android are on their “Coming Soon” roadmap, indicating they are a development priority.

Wrapping It All Up

In the crowded world of finance apps, finance_stuff stands out with its strong focus on AI-driven automation and insightful projections. It’s not just another expense tracker; it’s an ambitious attempt to build a truly intelligent financial co-pilot. While it's still young and has features yet to be rolled out, the foundation is solid and the vision is compelling. If you're tired of your spreadsheet monster, it might be time to see if AI can finally tame it for you.

Reference and Sources

- finance_stuff Official Website: stuff.finance

- N26: https://n26.com/

- Adyen: https://www.adyen.com/