Remember that feeling? You’re scrolling through your feed and see a ticker symbol you’ve never heard of, up 300%. It’s the next GME, the next AMTD, and you completely missed it. The regret stings. You think, “If only I’d known…” We’ve all been there. I’ve been trading and writing about this stuff for years, and that feeling of being a day late and a dollar short never really goes away.

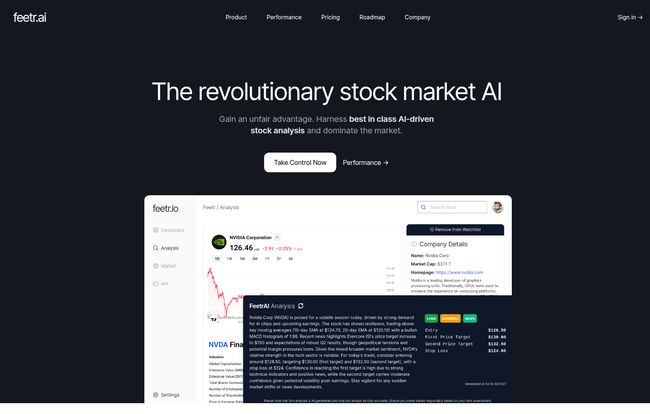

The market has always been a battle of information. The person with the best data, and the ability to interpret it the fastest, usually wins. For a long time, that advantage belonged to the big institutional players with teams of analysts. But the game is changing. Lately, I've been playing around with a tool that claims to level the playing field a bit: Feetr.ai. It's an AI-powered platform that promises to give you an edge by predicting stock price movements, and honestly, I was skeptical. An 80% accuracy claim? C'mon. But I had to see for myself.

So, What is Feetr.ai, Anyway?

Think of Feetr.ai less like a crystal ball and more like a super-powered weather forecaster for the stock market. It’s not just another stock screener that filters by P/E ratios and market caps. Instead, it uses a hefty dose of artificial intelligence and machine learning to sift through a mountain of data—we're talking real-time market trends, social media chatter, news sentiment, and historical performance. Its whole deal is trying to decipher the delicate dance of supply and demand for any given stock before the rest of the market catches on. It's like having a tireless analyst who never sleeps, constantly gauging the market's mood.

The goal isn’t to give you a magical “buy this now” button, but to deliver actionable insights that help you make smarter, more informed decisions. At least, that's the sales pitch.

Visit Feetr.ai

The Features That Actually Matter

Any platform can throw a bunch of features at you. What I care about is what actually works and what can genuinely give me an edge. Here's what stood out to me in Feetr.ai.

AI-Powered Sentiment Analysis

This is the secret sauce, in my opinion. We saw with the whole WallStreetBets saga that market sentiment, especially on platforms like Reddit and Twitter, can be a massive driver of price action. Feetr.ai’s AI is designed to pick up on this chatter. It goes beyond simple keyword tracking and tries to understand the feeling behind the conversation. Is the sentiment turning bullish? Is there a groundswell of bearish opinion forming? Getting a read on this before it hits the mainstream news can be incredibly powerful.

Those Precise Price Targets

Okay, let’s talk about the price targets. The platform generates specific price targets for stocks it analyzes. I always take AI-generated predictions with a grain of salt – and you should too. No algorithm can predict a surprise announcement or a random global event. However, having these AI-generated targets provides a fantastic data point. It’s one more piece of the puzzle, a logical projection based on the available data, which you can then weigh against your own research and analysis.

An AI That Gets Smarter

Another thing to note is the “Adaptive Learning Algorithms”. This isn't a static piece of software. The AI is constantly learning from new data and refining its models. In theory, this means it should get better and more accurate over time as it digests more market behavior. I like that. It’s not a one-and-done product; it’s an evolving system. That’s a crucial distinction in a market that changes by the second.

Who Is This Tool Really Built For?

Feetr.ai seems to understand that not all traders are cut from the same cloth. They’ve structured their platform to appeal to a few different types of users, from the curious newcomer to the seasoned pro.

- The Retail Trader: This is for the everyday person, maybe someone with a 9-to-5 who trades on the side. You get the core daily stock analysis and a decent number of AI generations per month to research your picks. It's a great entry point to see if this kind of analysis fits your style.

- The Whale Trader: This is for the more serious, active trader. For a higher price tag, you get way more AI generations, unlimited API access (huge if you're a bit of a dev and want to build custom tools), and you get to play with new features before anyone else. This seems to be their sweet spot.

- The Institutional Trader: This is the “call us” plan. Big firms, hedge funds, you know the type. Custom integrations, priority support, and basically an all-you-can-eat AI buffet. It's for the big leagues.

Let's Talk Money: Feetr.ai Pricing

Alright, the all-important question: what’s it gonna cost me? The pricing structure is pretty straightforward, which I appreciate. No hidden fees or confusing credit systems. It's a monthly subscription model.

| Plan | Price | Key Features |

|---|---|---|

| Retail Trader | $14.99 / month | Daily Stock Analysis, 200 FeetrAI generations/month, Limited API. |

| Whale Trader | $49.99 / month | Daily Stock Analysis, 1500 FeetrAI generations/month, Unlimited API, Early access to new features. |

| Institutional Trader | Custom (Let's Talk!) | Unlimited FeetrAI, Custom Integrations, Priority Support. |

My take? The $14.99 plan is a no-brainer if you're curious. It's less than a few regrettable trades would cost you, and it gives you a real feel for teh platform. The Whale Trader plan at $49.99 is where the real power lies for serious individual traders, especially with that unlimited API access.

The Good, The Bad, and The AI

No tool is perfect. Let's be real. After spending some time with Feetr.ai, here’s my honest breakdown.

What I'm Excited About

The AI-powered analysis is genuinely impressive. It’s not just regurgitating news; it’s providing a layer of interpretation that would take a human hours to replicate. The potential to spot sentiment shifts early is a massive pro. And for the price of the retail plan, it feels like a very accessible way to add a sophisticated tool to your arsenal. It gives you actionable data, not just a flood of numbers.

A Few Words of Caution

First off, it’s a subscription. If you’re not actively trading, that monthly fee can feel like a drag. Second, and this is important, don't blindly trust the AI. It’s a tool for analysis, not a guarantee of profits. The market is chaotic, and no machine can predict it with 100% certainty. The ~80% accuracy they claim is high, but that still means it can be wrong 20% of the time. Use it to inform your decisions, not make them for you. There's also a risk of information overload if you're not careful. You need to know what you're looking for.

The Bottom Line: Is Feetr.ai Your Next Secret Weapon?

So, is Feetr.ai worth it? In my experience, yes, with a caveat. If you're looking for a get-rich-quick scheme, this isn't it. Nothing is. But if you’re a trader who does their homework and wants a powerful co-pilot to help you analyze the market sentiment and crunch massive amounts of data, Feetr.ai is a seriously compelling option. It feels like a genuine step forward from the traditional screeners and charting software we're all used to.

It won't replace your brain or your own due diligence. But it might just give you that little edge, that early warning, that helps you catch the next big move instead of reading about it the next day. And for a trader, that can make all the difference.

Frequently Asked Questions about Feetr.ai

- Can Feetr.ai guarantee profits?

- Absolutely not. No tool can. Feetr.ai is a sophisticated analysis platform designed to provide data-driven insights and predictions to help you make more informed decisions. The market is inherently risky, and all trades are your own responsibility.

- What kind of data does Feetr.ai analyze?

- It analyzes a wide range of sources, including real-time market data, global economic trends, social media platforms like Twitter and Reddit, news sentiment, and historical stock performance to build its models.

- Is Feetr.ai good for beginners?

- It can be, but you should still have a foundational understanding of trading concepts. The Retail Trader plan is a great starting point for beginners who want to augment their learning with AI insights. It simplifies complex sentiment data into more digestible insights.

- How is Feetr.ai different from a standard stock screener?

- A standard screener filters stocks based on fixed metrics you provide (like P/E ratio, market cap, etc.). Feetr.ai is predictive; it actively analyzes sentiment and data to forecast potential price movements and identify opportunities you might not find through filtering alone.

- What does '200 generations per month' mean?

- A "generation" refers to a single request for the FeetrAI model to perform a detailed analysis on a stock. So, the Retail Trader plan allows you to run this deep analysis on up to 200 different stocks (or the same stock 200 times) each month.