If you've ever tried to do your own stock research, you've probably felt that familiar wave of... dread. You start with good intentions, maybe trying to follow the wisdom of investing legends like Warren Buffett or Peter Lynch. You pull up a company’s 10-K report, and suddenly you’re staring at a 150-page PDF filled with legalese and financial tables that would make an accountant's eyes glaze over. It's a mess.

I’ve been there. More times than I can count. I’ve spent entire weekends fueled by coffee, sifting through SEC filings and trying to listen to monotone earnings calls, all to find that one golden nugget of information. It’s exhausting. For years, the barrier to deep, fundamental analysis wasn't a lack of information, but a lack of time and the tools to process it all.

Then AI came crashing into the scene. Suddenly, tools are popping up left and right promising to “revolutionize” investing. Most of them are... okay. Some are just fancy calculators with a chatbot attached. But recently, I stumbled upon a platform called Decode Investing, and I have to say, it caught my attention. It looked clean, it talked a big game, and it seemed to be built by people who actually understand the pain points of the modern investor.

So, I did what any self-respecting data nerd would do. I rolled up my sleeves and took it for a spin. Is this the AI sidekick we've all been hoping for? Let's get into it.

So, What Is Decode Investing, Really?

At its heart, Decode Investing is an intelligent research platform. Think of it less as a magic 8-ball that tells you what to buy, and more as a super-smart research assistant who can read incredibly fast and summarize things for you. Its main job is to take the mountains of dense, complex financial data—the SEC filings, the earnings calls, the market noise—and make it understandable for regular humans.

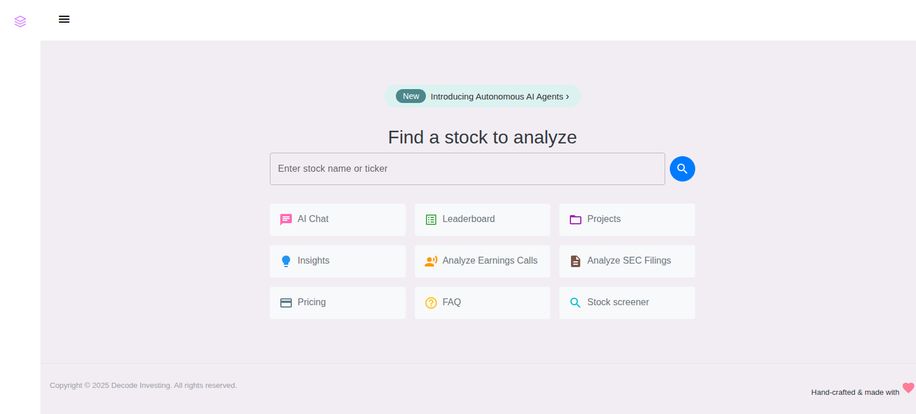

The homepage itself is refreshingly simple. No flashing stock tickers or overwhelming charts. Just a search bar and a clean grid of its main features. It feels approachable, which is a huge win in a field that often feels like an exclusive club.

Visit Decode Investing

It’s clearly designed for everyone from the complete beginner who just opened a brokerage account to the seasoned value investor who just wants to speed up their workflow. A a noble goal, for sure.

The Core Features That Actually Matter

A tool is only as good as its features, right? A lot of platforms pack in useless gadgets, but Decode seems to have focused on the stuff that moves the needle. Here’s what stood out to me.

Your Personal Team of AI Analysts

This is probably the coolest part. Decode doesn't just have one generic “AI.” It has a few specialized ones. You've got Lima for general stock market research, Saturday for breaking down earnings calls, and June for tackling those hefty SEC filings. It's like having a small team of junior analysts on call 24/7. You can ask them specific questions like, “What were the main risks mentioned in NVIDIA’s latest 10-K?” or “Summarize the management sentiment from Apple's last earnings call.”

The ability to 'interrogate' a document instead of just reading it is a genuine shift in how research can be done. It saves an incredible amount of time.

Analyzing SEC Filings Without Losing Your Mind

I can’t stress this enough: this feature is a lifesaver. Reading an 8-K or 10-Q is critical for due diligence, but it’s a total slog. Decode’s AI, June, can scan these documents in seconds and pull out the key information. This turns an hours-long task into a minutes-long one. It's not about being lazy; it's about being efficient. You can focus your brainpower on interpreting the information, not just finding it.

The New Kid on the Block: Autonomous AI Agents

This is a newer feature they're highlighting, and it’s intriguing. The idea of “Autonomous AI Agents” suggests a more proactive approach. Instead of you having to constantly ask questions, you can set up these agents to screen and analyze stocks based on your specific investment strategies. Imagine setting an agent to constantly look for companies with a P/E ratio under 15, growing revenue, and low debt in the tech sector. This moves the tool from being reactive to being a proactive discovery engine. I'm very curious to see how this develops.

Let's Talk Money: The Decode Investing Price Tag

Alright, the all-important question: what’s it going to cost? The pricing structure is actually quite reasonable and tiered logically. Here's a quick breakdown as I see it:

| Plan | Price | Who It's For |

|---|---|---|

| Free | $0 | The Tire-Kicker. You get a limited number of lookups and AI queries. Perfect for getting a feel for the platform to see if you like it. |

| Premium | $12.99/month or $119.88/year | The Serious Hobbyist. This is the sweet spot. You get unlimited company lookups and watchlists, plus a generous monthly allowance of 40 queries for each AI. For most people, this is more than enough. |

| Executive | $29.99/month or $299.88/year | The Power User. Unlimited AI questions and way more AI-generated insights. If you're a very active trader, a freelancer managing portfolios, or just obsessed with data, this is your jam. |

| Enterprise | Contact for price | The Institution. Customized solutions for financial firms. |

Honestly, the value in the Premium plan seems pretty solid. For about the price of two fancy coffees a month, you get access to tools that can save you dozens of hours of work. That's a trade I'd take any day.

The Good, The Bad, and The AI

No tool is perfect. Let’s get real about the pros and cons.

"The biggest advantage is speed. It collapses research time from hours into minutes, letting you focus on the 'why' instead of the 'what'."

The good is obvious. The time-saving aspect is massive. The interface is clean and doesn't make you feel stupid, which is a big deal in finance tech. It consolidates the work of several different tools (a screener, a news aggregator, a document analyst) into one place.

But what about the bad? Well, it's not really 'bad' so much as 'things to be aware of'. First, you can’t blindly trust the AI. It's an incredibly powerful summarizer and data finder, but it’s not an oracle. Some might argue that relying on AI can make you a lazy investor. My counterpoint is that it's a tool, like a calculator. It does the tedious computation so you can do the critical thinking. You still need to verify the information and, most importantly, form your own thesis. The AI's effectiveness is also tied to the quality of the source data—a classic GIGO (Garbage In, Garbage Out) scenario, though in this case, the source data is SEC filings, which is pretty solid.

So, Who Is This For?

After playing around with it, I see a few key people who would get a lot out of Decode Investing:

- The Curious Beginner: Someone who is genuinely interested in picking their own stocks but is completely intimidated by the jargon and endless reports. This tool acts as a translator.

- The Busy Professional: The investor who has a good job and a family, and just doesn't have 20 hours a week to dedicate to deep research. This helps them stay informed and find opportunities efficiently.

- The Experienced Investor: Even if you know how to tear apart a balance sheet, this can dramatically speed up your process. You can screen for ideas faster and get the gist of a company's latest report before deciding if it's worth a deeper, manual investigation.

In short, it’s for anyone who values their time and wants to make more informed decisions without getting bogged down in the process.

My Final Verdict

I'm impressed. I've seen a lot of fintech tools, and many overpromise and underdeliver. Decode Investing feels different. It feels practical. It's not trying to be a trading platform or a social network for investors. It has a clear mission: to make hard-to-get information easy to understand. And it does that very, very well.

It won't make you Warren Buffett overnight. It won't give you hot stock tips. But it will give you a powerful assistant that levels the playing field, saves you an incredible amount of time, and just might help you uncover your next great investment. For me, that’s more than worth the price of admission.

Frequently Asked Questions

- Is Decode Investing good for beginners?

- Absolutely. In fact, it's one of the best starting points I've seen. It simplifies complex topics like reading SEC filings, making serious investing much more approachable than just staring at a Yahoo Finance page.

- Can the AI tell me exactly what stocks to buy?

- No, and that's a good thing. It's a research and analysis tool, not a financial advisor. It provides data, summaries, and insights to help you make your own informed decisions. Always do your own due diligence.

- How does the AI analyze SEC filings?

- It uses Natural Language Processing (NLP) models trained on financial documents. It can understand the structure and context of a 10-K or 10-Q to identify and summarize key sections, like risk factors, management discussion, and financial performance.

- Is the Premium plan worth the cost?

- In my opinion, yes. If you are serious about managing your own portfolio and the tool saves you even just a couple of hours of research time per month, it has easily paid for itself. The yearly plan offers the best value.

- What are the 'Autonomous AI Agents'?

- This is an advanced feature where you can set up AI-powered screeners to proactively find investment opportunities that match your specific criteria (e.g., certain valuation metrics, growth rates, etc.), saving you from running manual screens constantly.

- How is this different from a tool like Finviz or Seeking Alpha?

- Finviz is primarily a powerful stock screener. Seeking Alpha is more of a crowd-sourced content platform with articles and analysis from various authors. Decode Investing's core strength is its AI-driven analysis of primary source documents like SEC filings and earnings calls, which is a different focus. It's less about opinions and more about processing raw data for you.