We’ve all been there. Staring at a stock chart, feeling that little flutter of… something. Maybe it’s a gut feeling. Maybe it’s something you overheard from that guy at the gym who suddenly thinks he’s Warren Buffett. You click “buy,” and for a week, you’re a genius. Then, gravity remembers its job, and you’re left holding a bag of expensive regret.

I’ve been in the SEO and traffic game for years, and I see parallels everywhere. You can either throw content at the wall and see what sticks (the gut feeling approach), or you can use data to make intelligent choices. For a long time, serious stock market data was the playground of hedge funds with server rooms the size of my apartment. But the game is changing. And tools like Danelfin are a big reason why.

I’ve been kicking the tires on this AI-powered stock analytics platform for a while now, and I’ve got some thoughts. Is it a magic crystal ball? Nope. But is it a seriously powerful co-pilot for your investment strategy? Yeah, I think it might be.

So, What Exactly is Danelfin?

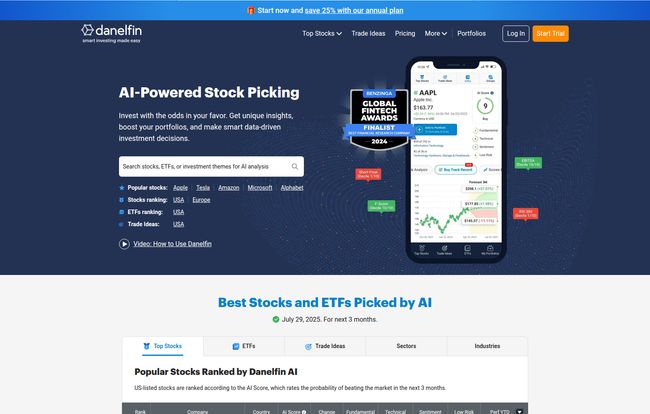

Imagine you had a team of super-smart, lightning-fast analysts who never sleep. Their only job is to sift through mountains of information for every stock you’re interested in. We’re talking over 10,000 different features—fundamental data (like earnings), technical indicators (like price momentum), and sentiment data (like what people are saying online)—every single day.

That's essentially what Danelfin is. It’s an AI platform that does the heavy lifting, crunching all that data to give you a simple, actionable rating. Its goal isn’t to tell you what to do. It’s to give you the data-driven confidence to make better decisions for yourself. It’s about replacing that gut feeling with something a whole lot more substantial.

The AI Score: The Heart of the Machine

Everything on the platform revolves around the AI Score. This is Danelfin's secret sauce. It’s a simple rating from 1 to 10 that tells you the probability of a stock outperforming the market (specifically, the S&P 500) over the next 3 months.

- Score 7-10: High probability of beating the market. (Green light)

- Score 4-6: Neutral. Might keep pace. (Yellow light)

- Score 1-3: Low probability. Likely to underperform. (Red light)

Simple, right? But here’s the part that really got my attention.

It’s Not Just a Black Box

My biggest beef with a lot of AI tools is that they’re a black box. They spit out an answer, and you’re just supposed to trust it. Why is this stock a 'buy'? Because the algorithm said so. It's not good enough. Danelfin, thankfully, seems to get this. They call it “Explainable AI.” When you look up a stock, it doesn’t just give you the score; it breaks down the why. It shows you the top positive and negative indicators that influenced the score. Maybe its got great fundamentals but terrible price momentum. Or maybe the market sentiment is off the charts, but its valuation metrics are a bit scary. This context is everything. It lets you look under the hood of the AI engine, which for a data nerd like me, is fantastic.

Visit Danelfin

My Favorite Features Beyond the Score

The AI Score is the headliner, but the supporting cast is pretty strong too. The Trade Ideas section is a great starting point if you’re hunting for new opportunities. It curates lists like “Top Tech Stocks” or “Best Value Stocks” based on high AI Scores, giving you a pre-vetted list to start your own research.

I also really like the portfolio monitoring tools. You can plug in your current holdings and Danelfin will track them, giving each one an AI Score and an overall health rating for your portfolio. It's a brilliant way to get an unbiased, data-driven second opinion on the stocks you already own. Sometimes it’s validating, and sometimes its the wake-up call you probably needed.

Let’s Talk Money: The Danelfin Pricing Plans

Alright, the all-important question: what’s this going to cost? Danelfin has a tiered system that I think is pretty fairly structured.

There's a Free plan, which is more of a teaser than anything. You get a handful of stock reports a month and access to their daily newsletter. It's enough to get a feel for the platform, but you'll hit the paywall fast if you're doing any serious research.

The Plus plan is where it gets interesting. At $19/month (if you pay annually, which saves you 25%), you get unlimited stock reports, more trade ideas, and you can track a small portfolio. In my opinion, this is the sweet spot for most retail investors and serious hobbyists. It unlocks the platform's core value without breaking the bank.

Then there's the Pro plan at $59/month (again, with the annual discount). This gives you everything—unlimited everything, deeper analytics, more portfolio slots, and the ability to export data to a CSV file. This is aimed at the really active traders, financial advisors, or anyone managing a more substantial portfolio.

For what it does, the pricing feels right. It's a professional-grade tool, and the price reflects that, especially on the Plus tier.

A Necessary Reality Check: What Danelfin Isn't

I need to be crystal clear about this. Danelfin is not a get-rich-quick scheme. It cannot predict the future. Their own tagline says as much: “Nobody can predict the future, but our Artificial Intelligence can help you build a better one.” I love that honesty.

The AI Scores are based on backtested performance. This means they’ve run their model against historical data to see how it would have performed. As their performance charts show, the strategy has historically done very well against the S&P 500. But as every single financial prospectus will tell you, past performance is not an indicator of future results. A sudden market crash or a bizarre geopolitical event can throw even the smartest models for a loop.

Think of Danelfin as a ridiculously smart, data-savvy research assistant, not a financial advisor. The final decision is, and always should be, yours.

So, Is Danelfin Worth Your Time and Money?

After spending a good amount of time with the platform, my answer is a resounding yes, but with a caveat. It’s for a certain type of investor.

If you're the kind of person who wants to make informed, data-backed decisions and remove emotion from the equation, this tool is built for you. If you love digging into the 'why' behind a stock's movement and you want to build a portfolio based on probabilities rather than hype, you'll feel right at home. It’s for the investor who’s ready to graduate from Reddit threads and talking heads on TV to a more disciplined approach.

However, if you're looking for a magic button that just tells you what to buy and sell with no effort, this isn't it. It's a tool for analysis, not a replacement for thinking.

For me, it’s a powerful way to cut through the noise. And in today’s market, there is an awful lot of noise.

Frequently Asked Questions

- How accurate is the Danelfin AI Score?

- The AI Score measures the probability of a stock beating the market over the next 3 months. It's based on extensive backtesting against historical data, which has shown a strong correlation between high scores and market outperformance. However, it's a probabilistic model, not a guarantee of future performance.

- Can I try Danelfin for free?

- Yes, Danelfin offers a Free plan that allows you to get 10 stock/ETF reports per month and access to their daily newsletter. It’s a great way to explore the platform’s basic features before committing to a paid plan.

- Is Danelfin suitable for beginner investors?

- I'd say it's best for ambitious beginners to intermediate investors. While the AI Score is simple to understand, the real value comes from using the “Explainable AI” features to learn why a stock is rated the way it is. A complete novice might find the sheer amount of data a bit overwhelming at first.

- What markets does Danelfin cover?

- Danelfin analyzes all stocks and ETFs listed on U.S. markets (NYSE, Nasdaq, etc.) and is expanding its coverage. You can find a comprehensive list of all stocks it analyzes on their website.

- Does Danelfin give specific buy or sell signals?

- No. It provides an AI Score that rates the probability of outperformance. A high score (e.g., a 9 or 10) could be considered a strong positive signal, while a low score is a negative one. It's a tool for decision support, not an automated trading bot.

Final Thoughts

In a world drowning in financial information, tools that provide clarity are worth their weight in gold. Danelfin is one of the best I've seen at turning market chaos into actionable intelligence. It won't make you an overnight millionaire, but it just might make you a smarter, more confident, and ultimately more successful investor over the long haul. And that’s a goal worth investing in.