The world of online business compliance is a headache. It's a confusing alphabet soup of regulations—KYC, AML, IDV—that can make even a seasoned pro's head spin. For years, we’ve had to stitch together different services from different providers, creating this Frankenstein’s monster of a compliance workflow. It’s expensive, it’s clunky, and frankly, it's a huge pain.

So when I stumble upon a platform that claims to be an “all-in-one” solution, my professional skepticism kicks in. But my curiosity gets the better of me. That's what happened with ComplyCube. I’d been hearing whispers about it, saw it pop up in a few dev forums, and decided it was time to take a proper look. This isn't going to be a sales pitch. This is my honest-to-goodness breakdown, from one business operator to another.

What Exactly is ComplyCube Anyway?

Okay, let's cut through the jargon. At its heart, ComplyCube is a tool designed to answer one of the most fundamental questions in business: Is this customer who they say they are?

Think of it like a digital bouncer for your website or app. But instead of a clipboard and a velvet rope, it’s using some seriously smart technology to check IDs, screen for risks, and make sure you’re not accidentally doing business with a fraudster or someone on a global watchlist. It wraps up Identity Verification (IDV), Know Your Customer (KYC), and Anti-Money Laundering (AML) checks into one neat package.

For anyone new to the game, here's the quick and dirty:

- KYC (Know Your Customer): The process of verifying a client's identity. This is a legal requirement in a lot of industries, especially finance.

- AML (Anti-Money Laundering): A set of procedures and laws designed to stop criminals from disguising illegally obtained funds as legitimate income.

ComplyCube basically automates this entire, often tedious, process. And with a claimed 98% automation rate, that's a big deal for freeing up human resources.

The Core Features That Actually Matter

A feature list is just a list. What I care about is what it actually does for my workflow and my bottom line. ComplyCube has a ton of features, but I think they boil down to a few key areas that solve real-world problems.

Making Customer Onboarding Less of a Slog

I still have nightmares about the early days of online onboarding. It involved a week-long back-and-forth of scanned passports and blurry utility bills. It was awful for me and even worse for the customer. ComplyCube aims to kill that process, and I'm here for it.

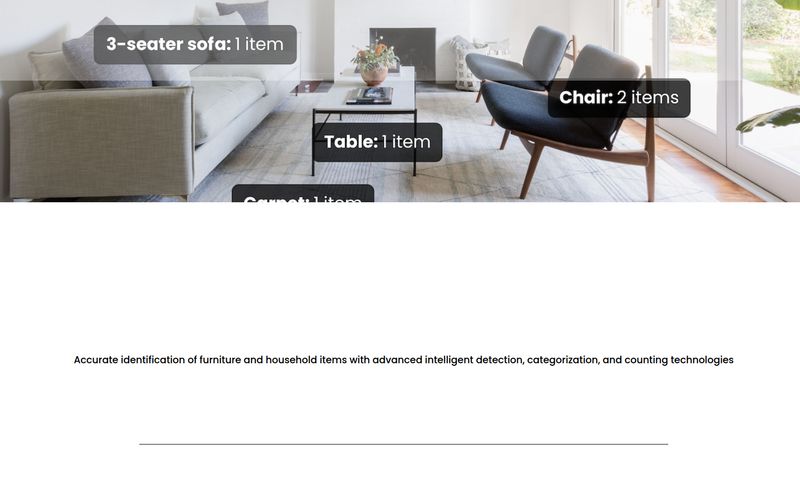

Their system combines a few things to make onboarding smooth. There’s the Document Check, which can handle over 3,000 document types from 220+ countries and territories. That global reach is massive. Then there's the Liveness Check and Facial Similarity Check, which asks the user to take a quick selfie to prove they're a real, live person and that their face matches the ID. It’s a smart, effective way to stop basic fraud in its tracks.

Visit ComplyCube

The Scary Stuff: AML Compliance and Fraud Prevention

This is the part of compliance that keeps founders up at night. Messing up AML isn't just a business error; it can have serious legal consequences. ComplyCube seems to take this very seriously.

Their platform provides continuous screening against global watchlists, sanctions lists, and checks for Politically Exposed Persons (PEPs). It also does Adverse Media Screening, which is a fancy way of saying it scours the web for negative news about a potential customer. Some might argue that this is overkill for a small business, however, in my experience, it’s far better to be safe than sorry. The fines for non-compliance can be company-killers.

Beyond Individuals with KYB Solutions

It's not just about individual customers. If you're a B2B company, you need to verify the businesses you're working with. This is where Know Your Business (KYB) comes in. ComplyCube offers company lookups and insights, helping you verify the legitimacy of a corporate entity, which is a feature you don't always see bundled in with standard KYC platforms.

Who is This Platform Really For?

Based on their features and positioning, ComplyCube seems to be casting a wide net. They specifically mention use cases for FinTech, crypto, agetech, and even professional services. Basically, anyone who has a regulatory need or just a strong desire to prevent fraud.

What I find particularly interesting is their Startup Program. This is a huge green flag for me. It shows they understand that early-stage companies need access to these powerful tools but might not have an enterprise-level budget. It's a smart move that builds goodwill. On the other end of the spectrum, their API-first approach signals that they are built for serious, scalable tech implementation, which will appeal to larger companies with dedicated development teams.

Let's Talk Money: ComplyCube Pricing Breakdown

Alright, the moment of truth. What does it cost? The pricing page is pretty transparent, which is a breath of fresh air.

| Plan | Price | Best For | Key Details |

|---|---|---|---|

| Basic | $249 / month | Startups & Small Businesses | Includes core features. Usage is pay-per-check (e.g., $0.50 per Document Check, $0.20 per Liveness Check). |

| Growth | Let's Talk (Custom) | Scaling Businesses | Adds AML screening, real-time monitoring, KYB solutions, and more advanced features. |

| Enterprise | Let's Talk (Custom) | Large-Scale Operations | Everything in Growth plus dedicated support, SLAs, full audit trails, and unlimited SSO. |

In my opinion, the Basic plan is a solid entry point. The $249 monthly fee gives you access to the platform, and the pay-per-check model means you only pay for what you actually use. You just have to be mindful and project your usage, as those per-check fees can add up if you're onboarding hundreds of users a month. The “Let’s Talk” for the higher tiers is standard practice in the SaaS world for high-volume clients. It allows them to create a bespoke package, which usually ends up being more cost-effective for the client than a rigid pricing tier would be.

The Good, The Bad, and The Complicated

No tool is perfect, right? Here’s my take.

The biggest pro is definitely the all-in-one nature. Having KYC, AML, and KYB on one platform, through one API, is a dream for operational efficiency. The sheer global coverage is another huge win. You're not left scrambling when you get a customer from a country your old system didn't cover.

As for the cons... I wouldn't call them dealbreakers, more like things to be aware of. The bespoke pricing for larger plans can be intimidating for businesses that just want a clear, upfront number. You have to engage their sales team. Also, like any tool that interacts with your users on the front end, you have to consider the implementation. Things like cookie consent and privacy policies need to be handled correctly, which can add a layer of complexity—though that's not really ComplyCube's fault, it's just the world we live in.

My Final Verdict

So, is ComplyCube the silver bullet for all your compliance woes? Maybe. It’s certainly one of the strongest contenders I’ve seen in a while.

It’s comprehensive, developer-friendly, and has a pricing model that can work for both small startups and huge enterprises. It’s not a magic wand—you still need a sound compliance strategy and internal processes. But as a tool to execute that strategy, it's incredibly powerful. It successfully turns a complex, fragmented problem into a streamlined, manageable workflow. For any business operating online today, that’s worth its weight in gold.

If you're in the market for a KYC/AML solution, I'd say ComplyCube is absolutely worth putting on your shortlist. It feels less like a tool you’re forced to use for compliance and more like a genuine partner in helping you grow your business safely and securely.

Frequently Asked Questions About ComplyCube

- Is ComplyCube legit and secure?

- Yes. They make a big point about being independently verified and compliant with standards like SOC 2 Type 2. For a platform handling this kind of sensitive data, that's non-negotiable, and they seem to have it covered.

- What is the main difference between KYC and AML?

- Think of it this way: KYC is about confirming identity ("Are you John Smith?"). AML is about assessing risk ("Is this John Smith on a terrorism watchlist or trying to launder money?"). They are related but distinct processes.

- Is the Basic plan enough for a small business?

- In my view, yes, it's an excellent starting point. It gives you the core IDV tools you need to get started. You'll just want to monitor your per-check usage as your user base grows to decide when it might be time to talk to them about the Growth plan.

- How does the pay-per-check pricing work?

- It's pretty simple. You pay the monthly platform fee ($249 for Basic), and then for each specific check you run, a small fee is added. For example, verifying one user might involve one Document Check ($0.50) and one Liveness Check ($0.20), for a total of $0.70 for that user's verification.

- Do I need to be a developer to use ComplyCube?

- Not necessarily. They offer a SaaS platform with a dashboard that allows for case management, so you can manage things without writing code. However, to get the most seamless integration into your own customer onboarding flow, you'll want a developer to work with their API.

- What countries does ComplyCube support?

- They support over 220 countries and territories, which is one of the most comprehensive I've seen. It’s very unlikely you'll have a customer from a location they don't cover.