If you run a business, you know the soul-crushing feeling of accounts receivable. It’s that special kind of purgatory where you've done the work, sent the invoice, and now… you wait. And wait. And then you send a “gentle reminder” that feels anything but gentle. It’s a time-suck, a cash-flow killer, and frankly, a total drag.

I’ve been in the trenches with this stuff for years, juggling spreadsheets, payment gateways, and accounting software that refuse to talk to each other. It’s like throwing a party where none of the guests speak the same language. Chaos. So, when a tool like Chargezoom comes along promising to be the all-in-one peacemaker, my professional skepticism kicks in. But so does my curiosity.

They talk a big game—slashing manual work by 80%, getting you paid 4x faster, and using AI to lower your fees. Big promises. Can they actually back it up? I decided to take a look under the hood.

So, What Is Chargezoom, Anyway?

Think of Chargezoom not just as another way to take a credit card payment. That’s missing the point. It’s more of an automation engine for your entire invoicing lifecycle. It sits between the invoice you create and the money hitting your bank account, and its whole job is to make that journey as short and painless as possible. It connects to your existing accounting software (a huge plus) and essentially puts your collections on autopilot.

Instead of you manually sending invoices, then follow-ups, then reconciling payments in QuickBooks, Chargezoom orchestrates the whole dance. It’s designed for the business owner who’d rather be, you know, running their business instead of playing accountant.

Visit Chargezoom

Ditching the Invoicing Woes We All Know and Hate

Every business owner has a story about a nightmare invoice. The client who “never got it.” The check that’s “in the mail.” The endless back-and-forth that takes up more time than the original project did. Chargezoom is built to tackle these very specific headaches.

The core problems it solves are universal: delayed cash flow that keeps you up at night, wasted hours on administrative busywork, and those sneaky payment processing fees that silently eat away at your profit margins. It's a three-headed monster, and most solutions only tackle one of the heads.

"Simple but powerful interface! Helps us to save hours every month in both processing payments and accounting."

– Belkis C. | Accountant

How Chargezoom Actually Streamlines Your Workflow

Alright, enough with the high-level stuff. How does it work in practice? I've found it boils down to a few key areas where it really shines.

Get Paid Without Playing 'The Chase'

This is the big one. Chargezoom automates invoice reminders, which sounds simple, but it's a game-changer. It’s the polite-but-persistent nudge your clients need, without you having to be the bad guy. It also gives your clients a self-service portal where they can view their invoices and pay online instantly with a card or ACH. The easier you make it for people to pay you, the faster they will. It’s not rocket science, but so many systems get it wrong.

Put Your Accounting on Autopilot

For me, the real magic is in the integrations. The fact that it syncs directly with major accounting platforms like QuickBooks, Xero, NetSuite, and Sage Intacct is huge. This eliminates the dreaded manual reconciliation. When a payment is made through Chargezoom, it's automatically marked as paid and reconciled in your accounting software. Think about the hours that saves. No more exporting CSVs or trying to match up payment gateway reports with your bank statement. It's a beautiful thing.

The "AI" Secret Sauce for Lower Fees

Okay, “AI” is a term that gets thrown around a lot these days, usually as marketing fluff. Here, it seems to have some actual substance. Chargezoom claims its AI enriches transaction data before sending it to the processor. What does that even mean? In the world of payment processing, more data equals less risk. By providing more information about a transaction (Level 2 and Level 3 data), you can often qualify for lower interchange rates from the card networks like Visa and Mastercard. Chargezoom automates this data-enriching process, potentially cutting down your processing fees by up to 40%. This is not a standard feature in most simple payment gateways and could represent serious savings for businesses with high sales volume.

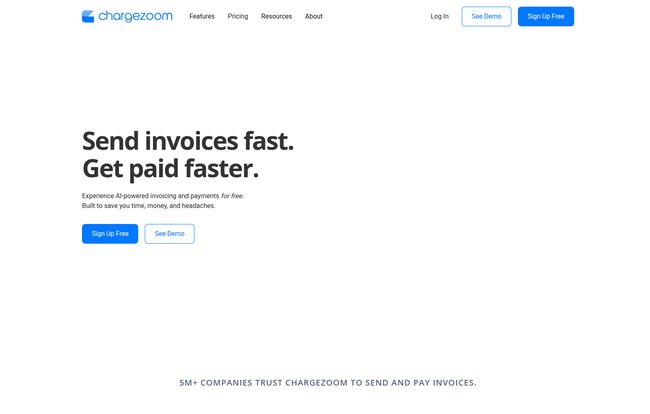

A Breakdown of Chargezoom's Pricing

Pricing is always the million-dollar question, isn't it? Or in this case, the $0 to $995 question. Chargezoom has a tiered structure that’s actually pretty logical for growing businesses.

| Plan | Price | Card Rate | Best For |

|---|---|---|---|

| Free | $0/month | 2.9% + $0.30 | Freelancers, solopreneurs, and small businesses just starting with QuickBooks. |

| Plus | $95/month | 2.7% + $0.25 | Growing businesses that need more users (up to 10) and integrations with Xero, etc. |

| Enterprise | $995/month | Interchange Plus | Larger companies with multiple locations, high volume, or complex needs requiring dedicated support. |

Honestly, the Free plan is a fantastic entry point. You get unlimited invoices and the core automation features for QuickBooks users, which is pretty generous. The Plus plan feels like the sweet spot for most established small-to-medium businesses. The lower processing rate and additional integrations justify the monthly fee if you have decent volume. The Enterprise plan is for the big players who need the most cost-effective processing (Interchange Plus) and white-glove service.

The Real Talk: What Are the Downsides?

No tool is perfect, and it would be dishonest to pretend otherwise. While Chargezoom gets a lot right, there are a few things to keep in mind.

First, there's the initial setup. Integrating any new software into your existing accounting system requires a bit of upfront work. It’s not just a plug-and-play mobile app. You'll need to connect your accounts, configure settings, and maybe import some data. It’s an investment of time, but one that should pay off. Second, the effectiveness of the AI-powered rate optimization can vary. It depends heavily on the type of cards your customers use and your business type. It’s a powerful feature, but your mileage may vary. Finally, its greatest strength—the third-party integrations—is also a potential point of dependancy. If your accounting software has an API issue, it could affect Chargezoom's functionality. That's true of any connected app, but it's worth acknowledging.

So, Is Chargezoom Worth the Hype?

After digging in, I have to say I’m pretty impressed. Chargezoom isn’t just selling a feature list; it’s selling a solution to a real, painful business problem. It’s for the business that has graduated from simple PayPal invoices but isn’t ready for a full-blown, six-figure ERP system.

If you're a service-based business, a B2B company, or anyone who regularly sends out invoices and feels the pain of manual follow-up and reconciliation, then yes, I think Chargezoom is absolutely worth a serious look. The potential time savings alone are compelling, and the possibility of lower processing fees is the cherry on top. It turns accounts receivable from a reactive chore into a proactive, automated system. And that’s something I can get behind.

Frequently Asked Questions About Chargezoom

1. Is Chargezoom a payment gateway or a processor?

It's best to think of Chargezoom as an automation layer that sits on top of payment processing. It provides its own competitive processing rates but its main function is to automate the invoicing and reconciliation process with your accounting software.

2. What accounting software does Chargezoom work with?

As of now, it integrates with the big ones: QuickBooks (Online and Desktop), Xero, NetSuite, Sage Intacct, and Microsoft Dynamics. The specific integrations available depend on your pricing plan.

3. How secure is Chargezoom for handling payments?

Very. They use a secure, PCI-compliant credit card vault to store customer payment information. This means sensitive data never touches your own servers, which drastically reduces your compliance burden and liability.

4. Can I really get lower credit card processing fees?

It's definitely possible. By submitting Level 2/3 data, which Chargezoom helps automate, you can qualify for lower interchange rates on business, corporate, or purchasing cards. This will be most impactful for B2B companies but can provide benefits for B2C as well.

5. Is the free plan really free?

Yes, the plan itself is $0 per month. You will still pay standard payment processing fees when a customer pays you via credit card (e.g., 2.9% + $0.30 per transaction). There's no monthly subscription fee for the software on that tier.

Final Thoughts

Chasing money is the worst part of being in business. Tools that can minimize that pain are worth their weight in gold. Chargezoom seems to have hit on a winning formula: automate the reminders, simplify the payment process, and handle the bookkeeping. It’s a powerful combination that gives you back your most valuable asset: time. If your invoicing process feels like a constant headache, this might just be the aspirin you've been searching for.