If you work in financial services, especially in the fast-moving world of fintech, you know the beast that is regulatory compliance. It’s a monster fed by an endless diet of dense legal documents, acronym-soup regulations, and ever-shifting guidelines. I’ve spent more nights than I care to admit staring at spreadsheets, trying to translate a 300-page document into a simple checklist of obligations. It’s the kind of work that makes you question your life choices.

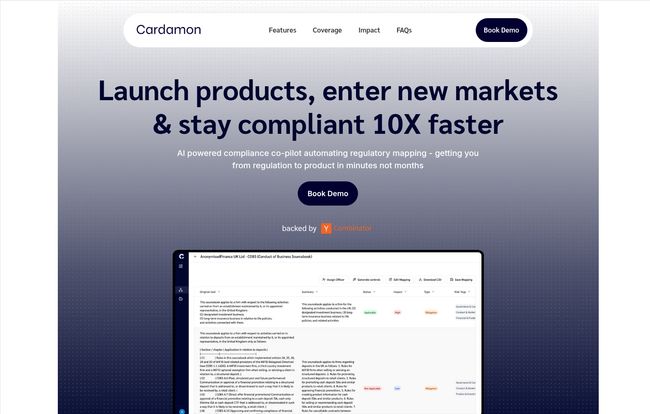

For years, we've been promised that technology would save us. And 'RegTech' has become a major buzzword, with dozens of platforms claiming they’re the silver bullet. So, when a new tool called Cardamon lands on my desk promising to make firms compliant 10X faster, my inner skeptic raises an eyebrow. That’s a massive claim. But my inner, sleep-deprived compliance nerd is also intrigued. Could this actually be it? Let's take a look.

What Exactly is Cardamon? Breaking Down the Pitch

At its core, Cardamon is an AI-powered platform designed to do one thing exceptionally well: automate the grunt work of regulatory compliance. The big idea is to take those monstrously complex regulations—think MiFID, DORA, SEC rules—and use artificial intelligence to read, understand, and map them to concrete obligations for your specific firm.

Their headline promise is getting you from "regulation to requirements in minutes, not months." I’ve seen this process take entire quarters, so the idea of doing it in the time it takes to drink a coffee is... well, it’s appealing. It positions itself as a co-pilot for compliance teams. It’s not here to take your job; it’s here to take the most tedious, repetitive parts of it off your plate so you can focus on strategy and implementation. A pretty smart angle, if you ask me.

The Core Features: Where the AI Magic Happens

Okay, so how does it actually work? The platform seems to be built around two main pillars: the AI-driven analysis and the human-in-the-loop finalization.

AI-Powered Obligation Mapping: The Heart of the Machine

This is the engine room. You feed Cardamon a regulation, and it gets to work. It’s not just pulling out keywords; it’s designed to understand context and extract the actual tasks and responsibilities your firm needs to adhere to. It then goes a few steps further by automatically generating an initial impact assessment for each obligation, tagging them with relevant risks (like financial crime or operational risk), and even producing a first draft of the compliance controls you'll need. Honestly, this part alone is the digital equivalent of having a team of hyper-caffeinated junior analysts who never sleep or make typos.

The 'Last Mile' Compliance: Putting a Human Touch on It

Here’s what I think is Cardamon's smartest move. They acknowledge that AI isn't infallible. The 'Last Mile' feature is where the compliance officer—the human expert—steps in. The AI provides a comprehensive, editable draft, and you take it from there. You can tweak the language, assign specific obligations to team members, add your own insights, and review everything before it goes live. Then you can download it all as a CSV to plug directly into your existing GRC tools or project management software. It’s a fantastic bridge between raw AI power and the nuanced reality of running a compliance program. You get the speed of the machine without sacrificing the wisdom of the expert.

Visit Cardamon

The Big Promise: What Does Cardamon Actually Save You?

Time and money. It's the classic promise of any B2B tool, but the figures Cardamon puts forward are eye-popping. They claim to save an average of +500 hours per compliance officer per year and over $100,000 in costs from manual work and consultants. Let's just pause on that for a moment.

What could your team do with 500 extra hours? They could be proactive instead of reactive. They could stress-test your existing controls, train staff more effectively, or research upcoming regulatory changes. It shifts the entire function from a cost center to a strategic enabler. And for a fintech startup, an extra $100k in the bank is another engineer's salary or a marketing budget that could fuel real growth. It’s like switching from navigating with a paper map and a compass to using a GPS. Both can get you there, but one is faster, less stressful, and lets you focus on the actual drive.

Let's Talk Coverage and Cost

A tool is only as good as its library, and for a RegTech platform, that means its regulatory coverage. So, how global is Cardamon?

Jurisdictions Covered: From the UK to the US

Right now, their website highlights a strong focus on major financial hubs: the UK (FCA, MiFID), Europe (MiFID, DORA), and the US (SEC, FINRA). This covers a huge swath of the fintech landscape. What’s more, they have a button that says, "Request a regulation." I love this. It shows they're building the platform with their clients and are ready to expand based on demand. It’s a good sign.

The Elusive Pricing Question

Ah, the part you were scrolling for. The price. Well, there isn't one listed on the site. Cardamon uses the classic "Book a Demo" model, which is pretty standard for specialized enterprise software. Don't let it put you off. In my experience, this usually means pricing is tailored to the customer. It'll likely depend on factors like the size of your company, how many users need access, and which regulatory libraries you need to unlock. It’s not a one-size-fits-all product, so it doesn't have a one-size-fits-all price tag. The demo is your chance to see if it's worth the investment.

The Good, The Bad, and The AI-Reliant

No tool is perfect. While Cardamon looks incredibly promising, it’s important to have a balanced view. The big wins are obvious: massive time savings, potential cost reductions, and a centralized platform to manage the chaos. It empowers the compliance function in a way that spreadsheets never could.

On the flip side, there will be an initial setup phase to get everything integrated into your workflow. But the main consideration, the one you have to grill them on in the demo, is the reliance on AI accuracy. How good is the model? How often is it updated? What’s the margin of error? The entire value proposition rests on the AI's ability to interpret complex legalese correctly. The 'last mile' editing feature is a great safety net, but you’re still putting a lot of faith in the initial AI-generated output.

Cardamon vs. Just Using ChatGPT?

It's a fair question, and one they even put in their own FAQ. Why not just copy-paste a regulation into ChatGPT and ask it to pull out the obligations? You could, but it would be like using a kitchen knife for brain surgery. ChatGPT is a generalist marvel; it knows a little about a lot. Cardamon is a specialist. It’s been trained specifically on the language, structure, and nuances of financial regulations. It understands the context in a way a general model likely cant. Plus, it’s built into a workflow with features like risk tagging, control generation, and team assignments—things you'd have to jury-rig yourself with a generic AI tool.

Frequently Asked Questions about Cardamon

I've rounded up a few common questions to give you some quick answers.

- Who is Cardamon for?

- It's designed for any regulated financial firm, from scrappy fintech startups trying to launch their first product to established banks looking to streamline their compliance departments. If you deal with regulations from the FCA, SEC, or similar bodies, it’s built for you.

- How does the AI work?

- In simple terms, the AI ingests the raw text of a regulation, uses natural language processing to identify and extract specific obligations, and then structures that data into a usable format, complete with initial risk assessments and controls.

- Why not just use a generic AI?

- Specialization is the key. Cardamon's AI is fine-tuned for the unique language of financial law. This leads to higher accuracy and relevance. Plus, it’s embedded in a purpose-built compliance workflow, not a general chat interface.

- What regulations do you cover?

- They currently focus on major regulations in the UK, Europe, and the US, including MiFID, DORA, and rules from the FCA and SEC. They also have an option to request new regulations, which is a great touch.

- How is the output customized?

- The AI output is fully editable. Your team has the final say. You can change text, assign tasks to colleagues, and then download the entire mapping as a CSV file for easy import into other systems.

Final Thoughts: A Powerful Accelerator, Not a Magic Bullet

So, is Cardamon the end of manual compliance work? Maybe not the end, but it looks like a hell of an accelerator. It tackles the most soul-crushing part of the job—the initial mapping and analysis—and frees up compliance professionals to do the high-value, strategic work they were actually hired for.

The human element remains absolutely critical. This tool doesn't replace a skilled compliance officer; it gives them a significant advantage. If you're tired of drowning in regulations and you believe technology can offer a better way, then Cardamon is definitely worth a closer look. Booking that demo might just be the most productive 30 minutes you spend all year.