I’ve been in the digital marketing and traffic game for what feels like a lifetime. I’ve seen countless platforms promise to be the “next big thing.” Most of them are just shiny new wrappers on the same old ideas. So when I first heard about Calypso Copilot, an AI tool for public equities, my cynical side kicked in immediately. Another AI gimmick? Probably.

But then I looked closer. And I have to admit, my curiosity got the better of me. This wasn't just another generic AI chatbot being shoehorned into a finance template. The language they used, the features they highlighted… it felt like it was built by people who have actually lived the pain of investment research. The late nights, the endless PDF reports, the brain-numbing task of sifting through hours of earnings calls. I’ve been there. Maybe you have too. So, I decided to give it a proper look. And honestly? I'm pretty impressed.

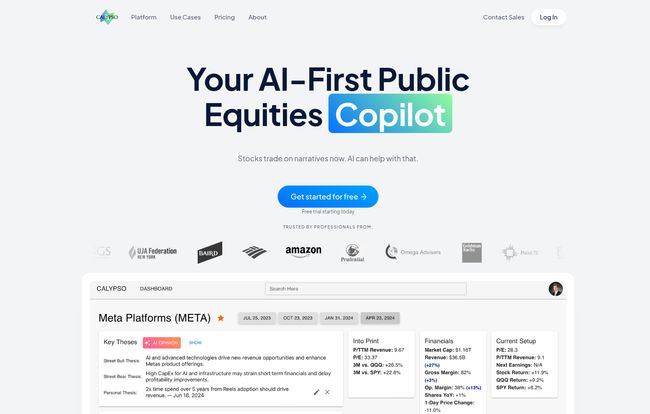

So, What Exactly is Calypso Copilot?

Let's get one thing straight: Calypso isn't trying to be an autopilot for your portfolio. Thank goodness. The last thing any of us need is to blindly hand our money over to a black box algorithm. Instead, it bills itself as an “AI-First Public Equities Copilot.” And that “copilot” distinction is everything.

Think of it like this: you’re still the pilot. You’re in charge of the destination (your investment goals) and the final decisions. Calypso is the highly intelligent, data-binging first officer sitting next to you, handling the tedious stuff. It monitors the instruments, cross-references flight plans with weather data, and points out things you might have missed while you were focused on the bigger picture. It combines all the public data you'd expect—financials, news, filings—with a powerful AI that’s been specifically trained by… and this is the important part… buy-side professionals.

We’re talking about an AI that’s learned from the workflows of analysts at places like Citadel and Point72. That’s a different league entirely from asking a generic AI, “Hey, is Apple a good buy right now?” This is a specialized tool for a specialized job. It's designed to level up your analysis, not replace it.

The Standout Features That Genuinely Impressed Me

A feature list is just a list until you see how it can change your workflow. Here’s the stuff that made me sit up and pay attention.

The Transcript Search is a Legitimate Time-Saver

I can’t be the only one who has spent a whole weekend mainlining coffee while CTRL+F’ing my way through dozens of earnings call transcripts. You're searching for that one single mention of a competitor or a comment on gross margins. It’s tedious, soul-crushing work. Calypso’s Transcript Search feature felt like a miracle. You can search for any keyword or phrase across all public transcripts and immediately jump to the mentions. This isn’t just a small convenience; this is giving you your life back. What used to take hours can now take minutes. For me, that alone is a massive selling point.

Pressure-Testing Your Ideas with AI Opinions

This is where the “copilot” idea really comes to life. We all get ideas about a stock. “I think the market is underestimating their new product line.” Okay, great. Now prove it. Calypso’s AI Opinions feature acts as your personal sparring partner. You can feed it your thesis, and it will analyze it, see what the street is debating, and extract the key bull and bear arguments. It’s like having a skeptical, incredibly well-read analyst on call 24/7 to poke holes in your theories before you put real money on the line. This helps you move from a “gut feeling” to a properly vetted investment thesis.

Visit Calypso Copilot

Having a Chat with a Wall Street Brain

The AI Chat function is more than just a Q&A bot. Because it's trained by buy-side proffesionals, the quality of the conversation is on another level. You can ask complex, nuanced questions about a single stock, and it will pull from its vast, integrated dataset to give you an answer. It’s incredible for quickly getting up to speed on a new company or digging into a specific aspect of a business you’re already following. It feels less like using a piece of software and more like brainstorming with a very, very smart colleague.

Who is This Tool Really Built For?

This is always a big question for me. Is it for the pros or the people? Calypso seems to be playing both sides of the field, and I think it works.

On one hand, you have the serious individual investor. The person who manages their own portfolio, reads the financial news, but doesn't have a Bloomberg Terminal on their desk. For them, Calypso is a massive equalizer. It provides access to a level of analytical power that was previously reserved for institutional investors. It helps you do your homework more efficiently and with greater depth.

On the other hand, it’s clearly built for the professional analyst or the boutique hedge fund. For them, the value is scale. It allows a single analyst to cover more stocks, test more theses, and stay on top of news flow without burning out. It’s an efficiency multiplier.

Breaking Down The Cost: What's the Damage?

Okay, let's talk price. This is often where the dream dies. But Calypso’s pricing model is actually pretty interesting and, dare I say, fair. They have two main tiers.

| Plan | Price per Month | Key Features & Limits | Best For |

|---|---|---|---|

| Basic | $10 | All financials, news, debates. 20 AI Opinions/day, 20 AI Chats/day. Also includes a 14-day free trial. | The serious individual investor or anyone wanting to test the waters. |

| Professional | $399 | Everything in Basic, but with 400 AI Opinions/day, 400 AI Chats/day, live support, and faster feature requests. | Professional analysts, small funds, or power users who live and breathe this stuff. |

That $10/month for the Basic plan is, frankly, a steal. For the price of two fancy coffees, you get access to a tool that could fundamentally change how you research stocks. The 14-day free trial makes it a complete no-brainer to try out. The jump to $399 for the Professional plan is significant, no doubt about it. But for a small fund or a full-time analyst where time is literally money, the expanded limits and priority support could easily pay for itself in a single good decision.

The Not-So-Perfect Parts: My Honest Criticisms

No tool is perfect, and it would be disingenuous to pretend otherwise. While I’m bullish on Calypso, there are a few things to keep in mind.

Firstly, the reliance on AI means you can't get lazy. This is my biggest warning. The AI is brilliant, but it's a tool for analysis, not a crystal ball. You still need to do your own thinking and take final responsibility. It augments your intelligence, it doesn't replace it. Secondly, the 20-per-day limits on AI Opinions and Chats in the Basic plan could feel restrictive if you're doing a really deep dive on a particular day. You have to be a bit strategic with your queries. And finally, as mentioned, that price jump to the Professional plan will be a barrier for many. It clearly separates the serious hobbyist from the full-time pro.

Frequently Asked Questions About Calypso Copilot

How does Calypso Copilot train its AI models?

This is their key differentiator. The AI is trained not just on a massive library of public financial data (like filings, transcripts, and news), but its framework and analytical models are developed with input and training from buy-side professionals from top-tier firms. This gives it a practical, real-world analytical edge.

Can I trust the AI's financial advice?

No, and you shouldn't trust any AI's direct financial advice. Calypso Copilot is an analytical and research tool, not a registered financial advisor. It provides data, insights, and counter-arguments to help you make more informed decisions. The final call is always yours.

Is the Basic plan good enough to start with?

Absolutely. For $10 a month, it's one of the best value propositions in the fintech space right now. The 14-day free trial means you can fully explore its capabilities without any commitment. It’s more than enough for most individual investors to significantly upgrade their research process.

How is this different from just using ChatGPT for stock research?

It's a world of difference. ChatGPT is a generalist large language model; it knows a little about a lot. Calypso Copilot is a specialist. It has real-time, integrated access to specific financial data sets and has been fine-tuned to perform specific tasks like extracting key debates and analyzing an investment thesis. The quality and specificity of the output are simply not comparable.

Is there a steep learning curve?

Based on the interface, it seems designed for intuitive use. If you're familiar with basic investment concepts and are comfortable using modern web applications, you should be able to get the hang of it very quickly. The value is in the power of the backend, not in a complex user interface.

My Final Verdict: Is Calypso My New Investment Copilot?

After spending time digging into what Calypso Copilot offers, I'm moving from “cynical observer” to “genuinely excited user.” This isn't just another tool; it feels like a paradigm shift in how individual investors can approach the market. It democratizes access to a level of analytical horsepower that used to be behind a very expensive, institutional wall.

It won't make you a better investor overnight. It won't give you hot stock tips. But it will make you a faster, more efficient, and more thorough researcher. It will challenge your assumptions and organize your thoughts. It’s a powerful partner in the complex, ever-changing world of public equities. For anyone serious about managing their own investments, giving the free trial a shot isn't just a recommendation; it feels like a necessity.