If you've ever run a business, been a freelancer, or worked in accounts, you know the feeling. The one that sinks in your stomach when you look at the 'Overdue' column in your spreadsheet. It's the absolute worst part of the job, isn't it? Crafting that perfectly balanced email—the one that’s friendly but firm, casual but also says, hey, my own bills would like a word.

I've spent more hours than I care to admit on this grim little dance. The follow-ups, the awkward phone calls, the spreadsheets tracking who's paid and who's ghosting you. It’s a massive time-suck and, frankly, a drain on your sanity. We've had automation tools for years, sure, but they've always felt a bit... dumb. Just blunt instruments sending the same generic reminder every seven days, regardless of the situation.

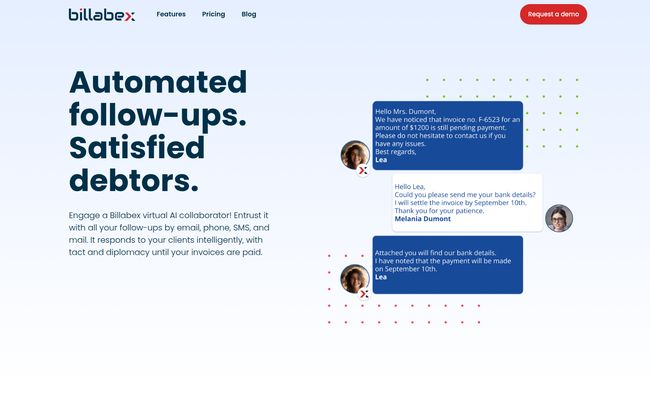

So when I started hearing buzz about AI-driven tools stepping into this arena, my ears perked up. Could a machine really handle this delicate, human task better than, well, a human? That’s the promise of platforms like Billabex, and I decided it was time to take a proper look.

So, What Exactly is Billabex?

At its core, Billabex is an automated invoice collection solution. But that’s like calling a smartphone a pocket calculator. It’s technically true but misses the entire point. Billabex doesn't just send reminders; it deploys a customizable 'virtual agent' to manage your accounts receivable for you. Think of it less as a simple automation and more like a super-patient junior accountant who never needs a coffee break and has the diplomacy of a UN ambassador.

This AI-powered agent doesn’t just blast out emails. It uses a multi-channel approach—we’re talking email, SMS, direct voicemail drops, phone calls, and even physical mail—to contact debtors. More importantly, it’s designed to be intelligent and empathetic. It can supposedly read the room, adapt its tone, and even handle basic questions and objections from your clients. A far cry from `REMINDER: INVOICE #123 IS OVERDUE`.

Visit Billabex

How Billabex Actually Works (The "Magic" Behind the Curtain)

Okay, so how does this digital debt collector do its thing? The process is refreshingly straightforward. You start by connecting it to your billing system or feeding it the necessary invoice data. This is that garbage in, garbage out principle we all know and love in the tech world; the better your data, the better the results will be.

Next, you customize your virtual agent. This part is pretty neat. You can define its communication style to match your brand's voice. Do you want it to be super formal and corporate, or more friendly and approachable? This ensures the AI doesn’t sound like a rogue robot that’s gone off-script. Once you set the parameters and let it loose, Billabex's machine learning kicks in. It analyzes debtor behavior over time, learning what works and what doesn't. Maybe one client responds best to an SMS at 10 AM on a Tuesday, while another only pays after receiving a polite voicemail. The system learns these nuances and personalizes its approach for each debtor.

This isn’t just a one-way street of nagging, either. If a client replies to an email with a question like, “Can I get a copy of the invoice again?” or “When is the project's next phase starting?”, the AI is designed to understand and provide an intelligent response. That two-way communication is a real game-changer.

The Good, The Bad, and The AI: My Take on Billabex

No tool is perfect, and anyone who tells you otherwise is probably selling it. After digging into Billabex, here’s my unfiltered take on where it truly shines and where you might hit a few bumps.

Where Billabex Shines (The Good Stuff)

The biggest, most obvious win is the time and resource savings. I can't even begin to calculate the cumulative hours I've personally wasted chasing payments. Handing that task over to a capable AI means you and your team can focus on, you know, actual revenue-generating work. But it’s more than just time. The platform’s ability to use multiple channels is huge. We all have that one client who has a million unread emails but will respond to a text in seconds. Billabex finds them where they are.

I also really appreciate the focus on empathetic communication. Traditional debt collection can be so aggressive that it burns bridges. Billabex’s whole philosophy seems to be about preserving the customer relationship while still getting you paid. It's a modern approach that recognizes you want to get paid, but you also want to work with that client again next year.

A Few Reality Checks (The Not-So-Good Stuff)

Alright, it’s not a magic wand you just wave over your accounts. First off, there's the initial setup. You need to get your invoice data integrated correctly, and you need to spend some time customizing the agent. Its not a one-click-and-go solution. If your records are a mess, this tool won't magically clean them for you.

You also need to be prepared to monitor it. While the AI is smart, you probably don't want to let it run completely unsupervised, especially in the beginning. What if a client has a truly complex, sensitive issue? You need a human ready to step in. I see this less as a 'set it and forget it' tool and more as a 'set it and supervise it' tool, which is still a massive improvement.

Let's Talk Money: Breaking Down Billabex Pricing

Pricing is always the elephant in the room. Instead of a flat monthly SaaS subscription, Billabex uses a pay-as-you-go model. You pay for each communication it sends. I’ve broken down their rates below for clarity.

| Communication Channel | Price (Excl. Tax) |

|---|---|

| €0.90 per email | |

| SMS | €0.90 per SMS |

| Voicemail | €1.50 per voicemail |

| Phone Conversation | €4.90 per conversation |

| Mail (Physical Letter) | €0.90 per mail + postage fees |

In my opinion, I actually like this model. It’s transparent. For freelancers or businesses with inconsistent invoicing cycles, it means you’re not bleeding cash on a hefty subscription during a slow month. However, for a company sending thousands of reminders, you’ll want to do the math to see if it makes sense compared to hiring a part-time AR clerk. For most small to medium-sized businesses, this seems like a very fair and scalable way to pay for the service.

Is Billabex the Right Tool For Your Business?

So, who is this for? I see Billabex being a fantastic fit for B2B businesses, creative agencies, consultants, and even solo freelancers who are tired of being their own collections department. If you value your time and your customer relationships, it’s a powerful ally for improving cash flow without the bad vibes.

It might be less suitable for businesses with extremely low-value invoices, where a €4.90 AI phone call could eat up a significant portion of the profit. It's also probably not a full replacement for a large, established AR team in a massive corporation, but it could certainly be a tool they use to handle the initial, high-volume follow-ups.

Frequently Asked Questions About Billabex

1. How does Billabex differ from standard automated reminders?

Standard automations are often one-way and generic. Billabex uses AI to personalize the timing, channel, and tone of its communication for each debtor. It also enables two-way conversations, allowing the AI to intelligently respond to basic customer queries.

2. Is the AI agent's communication style customizable?

Yes, absolutely. One of the core features is the ability to customize the virtual agent's personality and tone to align with your company's brand, ensuring a consistent customer experience.

3. What kind of integrations are needed for Billabex to work?

It relies on having access to accurate invoice and customer data. This typically means integrating with your existing billing software or CRM. The cleaner and more organized your data is, the more effective the tool will be.

4. Is the pay-per-use pricing model cost-effective?

It depends on your volume. For businesses with fluctuating or moderate invoice volumes, it can be very cost-effective as you only pay for what you use. For high-volume senders, it's worth comparing the projected costs against the cost of manual labor or a flat-rate subscription service.

5. How does Billabex handle customer data and privacy?

According to their site, they respect the confidentiality of customer data. As with any third-party tool that handles sensitive information, you should review their privacy policy and ensure it complies with regulations like GDPR. This is standard due diligence for any responsible business.

The Final Verdict on Billabex

Chasing payments is a necessary evil, but the way we do it is ripe for a change. Billabex presents a compelling vision for the future of accounts receivable—one that's smarter, more efficient, and surprisingly more human. It’s not about replacing people with robots; it’s about delegating the robotic tasks to an AI so that humans can focus on the things that matter: building relationships, solving complex problems, and growing the business.

If you're feeling the pain of late payments and drowning in follow-up emails, a tool like Billabex is definitely worth a serious look. It could be the key to fixing your cash flow and reclaiming your sanity. And in business, you can't really put a price on that.