Debt collection has an image problem. For most people, it conjures up images of aggressive phone calls, stressful letters, and a process that feels, well, a bit archaic. As a business owner, you're stuck between a rock and a hard place: you need to recover what's owed, but you don't want to burn bridges or unleash a team of unpredictable agents on your customers. It's a constant struggle of training, compliance, and frankly, a lot of headaches.

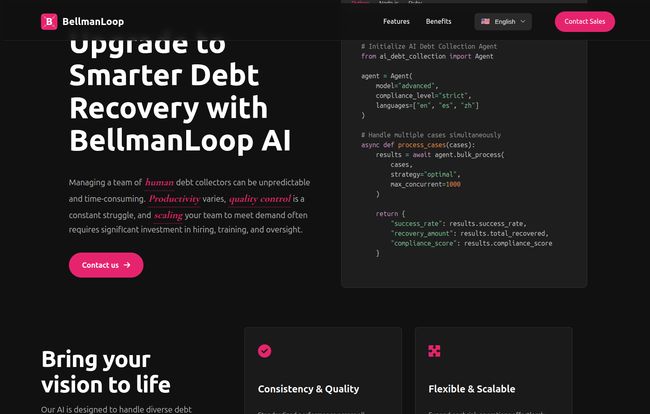

I’ve been watching the fintech space for years, and I'm always on the lookout for tools that don't just digitize an old process but actually rethink it. That’s why BellmanLoop caught my attention. It’s an AI-powered platform that claims to make debt recovery smarter, more efficient, and even more... humane? A bold claim. So, I decided to take a closer look.

So What Is BellmanLoop, Really?

At its core, BellmanLoop is a platform designed to automate and optimize the debt collection process using artificial intelligence. Think of it less like a call center and more like a highly intelligent, endlessly patient digital negotiator. Instead of relying solely on human agents to follow scripts and make calls, BellmanLoop uses a self-learning system to manage communications, tailor strategies, and handle multiple cases at once without ever needing a coffee break.

The main goal here isn't just to send out automated reminders. It’s about increasing the recovery rate per dollar you invest. It’s built to scale with your business, whether you’re expanding your services or just trying to get a better handle on your current accounts receivable. It promises consistency and quality, two things that are notoriously difficult to maintain with a human-only team.

Visit BellmanLoop

The Standout Features That Caught My Eye

Okay, “AI-powered” is a buzzword that gets thrown around a lot. What does it actually mean in this context? I peeked under the hood, and a few things genuinely stood out.

The Brains of the Operation: A Self-Learning System

This is the big one. BellmanLoop doesn't just run on a fixed set of rules. It has a self-learning system that analyzes past interactions, payment behaviors, and communication outcomes to refine its own strategies. It's like having a data scientist constantly tweaking your approach for maximum effect. It figures out what messaging works for which customer profiles and adjusts its approach. That’s a world away from a one-size-fits-all dunning letter.

Staying on the Right Side of the Law

Compliance is the monster under the bed for anyone in collections. Regulations like the Fair Debt Collection Practices Act (FDCPA) are no joke, and a single misstep by an agent can lead to massive fines. BellmanLoop puts a heavy emphasis on strict compliance. By automating the communication within pre-approved, compliant boundaries, it takes a huge amount of human error out of the equation. This is probably one of the biggest sighs of relief for any CFO or operations manager.

Speaking Your Customer's Language, Literally

The platform boasts both multi-language and multi-channel support. This is more important than it sounds. It’s not just about translating a message; it's about meeting the customer where they are. Some people respond to emails, others to SMS. Communicating in someone’s native language is a sign of respect that can completely change the tone of the interaction. It shifts the dynamic from adversarial to collaborative, which is exactly where you want it to be.

Data You Can Actually Use With Real-time Analytics

I’m a data guy. I love a good dashboard. BellmanLoop provides real-time analytics on performance, outcomes, and collection strategies. You're no longer guessing which of your agents is the best or which script is working. You can see the numbers, identify bottlenecks, and make informed decisions. This is how modern businesses should operate—based on facts, not gut feelings.

The Good, The Bad, and The AI-Powered

No tool is perfect. After looking at what BellmanLoop offers, here’s my honest breakdown of the pros and where I see some potential hurdles.

What I Really Like About BellmanLoop

The upside is pretty clear. You get a much more efficient and scalable operation. Imagine not having to hire and train five new collection agents because you can simply scale up your AI's capacity. That directly translates to lower operational costs. The improved recovery rates are the headline, but the consistency is a close second. Every interaction is professional and compliant, which protects your brand reputation and can even improve customer satisfaction. Yes, you read that right—improved customer satisfaction from a debt collection process. What a world.

A Few Things to Keep in Mind

Now, for a dose of reality. First, this is an AI system. It's smart, but it's not magic. Its effectiveness is directly tied to the data it receives. If your customer data is a mess, the AI will struggle. You have to feed the machine good information. Second, there's likely a learning curve. Integrating a platform like this into your existing CRM and billing systems will take some work. It’s not a simple plug-and-play app. Finally, while it automates a lot, you can't just set it and forget it. You’ll still need a human to monitor performance, handle complex edge cases, and oversee the whole strategy. It’s a powerful assistant, not a full replacement for human oversight.

So, How Much Does BellmanLoop Cost?

This is the million-dollar question, isn't it? I went looking for a pricing page, and... well, I found a dead end. A classic 404 page, in fact. While that gave me a little chuckle, it’s pretty standard for this type of B2B SaaS platform.

Pricing is almost certainly quote-based. The cost will depend on factors like the volume of accounts you're managing, the level of integration required, and the specific features you need. This makes sense, as the needs of a national lender are vastly different from those of a regional subscription-box company. You'll have to reach out to their sales team for a custom quote.

My Final Verdict: Is BellmanLoop the Future?

After digging in, I'm optimistic. BellmanLoop represents a significant shift in a field that's been ripe for change for a long time. It tackles the biggest pain points: inefficiency, compliance risks, and scalability. It turns collections from a brute-force numbers game into a more strategic, data-driven process.

Is it for everyone? Probably not. If you’re a small business chasing a handful of invoices, this is likely overkill. But for any medium to large company struggling to manage accounts receivable at scale, this is definitely a tool worth investigating. It’s a smart, modern approach that could not only boost your bottom line but also repair the often-strained relationship between businesses and customers in debt.

It's not just about getting paid; it's about doing it in a way that's smart, sustainable, and respectful. And that's a trend I can get behind.

Frequently Asked Questions About BellmanLoop

How is BellmanLoop different from a traditional collection agency?

Traditional agencies rely heavily on human agents, which can lead to inconsistency, high costs, and compliance risks. BellmanLoop uses AI to automate and optimize the process, providing consistent, scalable, and compliant interactions 24/7, driven by data rather than manual effort.

Is BellmanLoop compliant with collection laws?

Yes, a core feature of the platform is its focus on strict compliance. The system is designed to operate within the legal frameworks governing debt collection, like the FDCPA, reducing the risk of costly human errors.

How difficult is it to get started with BellmanLoop?

There will be an implementation period. Integrating the platform with your existing systems (like your CRM or accounting software) and feeding it the necessary data will require some initial setup and effort. It’s not an instant-on solution, but an enterprise-level integration.

Does BellmanLoop completely replace a human collections team?

Not necessarily. It's best viewed as a powerful tool that handles the bulk of the repetitive, scalable work. Most companies will likely still need human staff to manage the overall strategy, handle complex escalations, and oversee the system's performance.

What kind of businesses would benefit most from BellmanLoop?

Businesses with a high volume of accounts receivable are the ideal fit. This includes financial institutions, lenders, subscription-based services, telecommunications companies, and healthcare providers who need an efficient way to manage collections at scale.

Reference and Sources

- BellmanLoop Official Website: (Note: The official website was reviewed for this article)

- Fair Debt Collection Practices Act (FDCPA) Summary from the FTC: https://www.ftc.gov/legal-library/browse/rules/fair-debt-collection-practices-act-text

- Discussion on AI in Fintech: Forbes Advisor - AI In Banking