If you've ever tried to buy a home in Mumbai, you know the feeling. It’s a beast. A chaotic, beautiful, infuriating beast. The property hunt is one thing, but then comes the real fun: finding a home loan. You spend weeks bouncing between bank websites, drowning in jargon about floating vs. fixed rates, and trying to figure out which smooth-talking loan officer is actually offering you a good deal.

It’s exhausting. And frankly, it’s a process that’s been begging for a modern-day fix for years. I've been in the SEO and traffic generation world for a long time, and I get excited when technology genuinely tries to solve a real-human problem. So, when I stumbled upon a platform called AurumKuberX, which claims to use AI to find the best home loans in Mumbai, my ears perked up. An AI that can tame the Mumbai home loan market? I had to see this for myself.

Visit AurumKuberX

So, What Exactly is AurumKuberX?

At its core, AurumKuberX (or just KuberX, as they also call themselves) is a loan matchmaking platform. But instead of a person with a Rolodex, it uses artificial intelligence to do the heavy lifting. Think of it less like a bank and more like a super-smart financial assistant. You tell it what you need—your financial situation, the kind of property you're eyeing—and its AI engine crunches the numbers to find loan offers that are actually tailored to you.

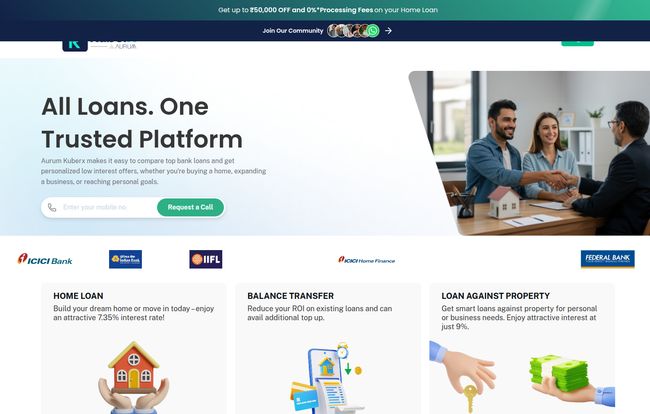

They partner with some heavy hitters in the Indian banking scene, like ICICI Bank, HDFC Bank, and IIFL, so you’re not just getting offers from some obscure lenders. You’re getting access to the big players, but without having to knock on each of their digital doors individually. The platform's whole reason for being is to cut through the noise and give you clear, customized loan options. A pretty bold promise, if you ask me.

How It Simplifies the Loan Hunt

The biggest turn-off for most people is the sheer complexity of the loan application process. AurumKuberX seems to get this, because they've boiled it down to a simple, three-step journey that doesn't require a degree in finance to understand.

The Three-Step Process Deconstructed

First, you Share Your Requirements. This is the part where you feed the machine. You'll input your details, your financial profile, and what you’re looking for in a loan. Standard stuff, but it's the foundation for everything else.

Second, you Compare Offers. This is where the AI magic supposedly happens. Instead of you manually building a spreadsheet to compare interest rates, processing fees, and weird hidden clauses, the platform presents you with customized offers from its network of banks. The idea is that the AI has already vetted these options based on your profile, so you’re looking at loans you’re more likely to be approved for.

And third? You Just Relax. Okay, maybe "relax" is a strong word when you're about to take on a massive loan, but the point is that their team helps handle the process from there—from final application to getting the money disbursed. They call it a "360° Loan Service," which sounds like they stick with you through the whole messy ordeal. For anyone who has been ghosted by a bank agent, that’s a pretty appealing thought.

More Than Just a Pretty Interface: The Smart Calculators

Now this is something I can really get behind. Before you even think about sharing your data, AurumKuberX has a suite of smart financial calculators right on their site. And these aren’t just cheap gimmicks. They include:

- EMI Calculator: The classic. Figure out what your monthly payment will actually look like.

- Eligibility Calculator: This is a big one. It gives you a ballpark idea of the maximum loan amount you can likely secure based on your income and other factors. Super useful for managing expectations.

- Loan Transfer Calculator: For those looking to refinance, this helps you see if switching your existing loan to a new bank would actually save you money.

- Affordability Calculator: This helps you estimate the loan amount you can comfortably repay, which is arguably more important than just seeing how much a bank is willing to throw at you.

Honestly, these tools alone are a huge help. It reminds me of the time I spent an entire weekend building a monster Excel sheet to do the exact same thing for a friend, only to have a formula break and throw everything off. Having these readily available is a godsend for getting your financial ducks in a row before you apply.

It's Not All Home Loans

While the big draw is definitely finding a home loan in Mumbai's cutthroat market, the platform isn't a one-trick pony. They also offer two other significant services:

A Balance Transfer, as I mentioned, is for people who are already paying off a loan but suspect they can get a better interest rate elsewhere. AurumKuberX helps you find a new lender willing to take on your existing loan at a lower rate, potentially saving you a ton of money over the long term.

They also facilitate a Loan Against Property (LAP). This is for property owners who need a chunk of cash for something else—like expanding a business, funding a child's education, or any other major expense. You essentially use your existing property as collateral to secure a new loan.

My Unfiltered Opinion on AurumKuberX

Alright, so it sounds great on paper. But as an SEO guy, I'm paid to be skeptical. Here’s my honest breakdown of the good and the not-so-good.

What I Genuinely Like

The specialization is a massive plus. By focusing its AI and services primarily on home loans in Mumbai, they can build a deep understanding of this unique market. They know the property trends, the specific requirements of banks in the region, and the typical profiles of Mumbai-based buyers. This isn't a generic, one-size-fits-all tool; its a specialized weapon.

The promise of unbiased financial guidance is also appealing. Bank agents work for the bank. KuberX, in theory, works for you. Their goal is to match you, not to push a specific bank's product. That alignment of interests is powerful. The testimonial on their site from Harvinder Singh also mentioned a "Reward System," which sounds intriguing, though there isn't much detail on it. Its a nice little hook.

Where It Could Improve

Let's be real, the laser focus on Mumbai is also its biggest weakness. If you're looking for a property in Delhi, Bangalore, or anywhere else, this platform isn't for you. At least not right now. It's a tool built by Mumbaikars, for Mumbaikars.

Another thing that gives me pause is the lack of transparent pricing. How do they make money? Is it a fee from the user? A commission from the bank? This isn't made clear on the website. I get that the service might be bespoke, but a little more transparency on the business model would build a lot more trust. Its a personal pet peeve of mine.

Finally, the term "AI" can sometimes be a buzzword. While the concept is fantastic, it can feel a bit like a black box. You put your information in, and offers come out. I’d love a bit more insight into how the AI makes its recommendations. What factors does it weigh most heavily? But maybe that's just the tech nerd in me talking.

Answering Your Burning Questions (FAQ)

Which bank will give the best ROI?

According to AurumKuberX, the lowest rate depends on several factors like your CIBIL score, income, and age. If you meet all the criteria, they can help you get the lowest possible rate available on the market.

What factors affect my loan eligibility?

The main factors are your age, income, existing financial obligations (other loans or credit card debt), and your credit history (CIBIL score). The property's value and legal status also play a big part.

What is the difference between Pre-Closure & Part Prepayment?

Pre-Closure is when you pay off the entire outstanding loan amount in one go before the tenure ends. Part Prepayment is when you pay off a portion of the principal amount, which can help reduce your EMI or shorten the loan tenure.

Is AurumKuberX free to use?

The website doesn't explicitly state its fee structure. Platforms like this typically earn a commission from the lending institution upon a successful loan disbursal, meaning it's often free for the user. However, it's best to clarify this with their team directly.

Is my personal information secure?

They state that your data will be held securely in accordance with their privacy policy. As with any financial platform, it's always a good practice to read the privacy policy before sharing sensitive information.

Who is this platform really for?

In my opinion, AurumKuberX is ideal for first-time homebuyers in Mumbai who feel overwhelmed by the loan process. It’s also great for busy professionals who don't have the time to do the research themselves and want a tech-forward solution.

The Final Verdict on AurumKuberX

So, is AurumKuberX the magic bullet for Mumbai home loans? For the right person, it just might be. It’s a modern, intelligent solution to an old, frustrating problem. It takes the legwork and a lot of the guesswork out of comparing loans, and its specialized focus on the Mumbai market is a clear advantage for locals.

Sure, I wish it were available more widely, and I'd love a bit more transparency on a few things. But you can't deny the appeal of having an AI assistant in your corner when you're navigating one of the toughest property markets in the world. If you're in Mumbai and on the brink of that home-buying journey, giving AurumKuberX a look seems like a very smart move.