If you're in the mortgage game, your inbox is a battlefield. It’s a constant barrage of borrower questions, underwriter requests, and follow-ups that feel like they never, ever end. I've spent more late nights than I care to admit fueled by lukewarm coffee, manually typing out the same email for the tenth time, all while a mountain of paperwork gives me the stink eye from the corner of my desk. We're told to be faster, more efficient, more personal—all at the same time. It's exhausting.

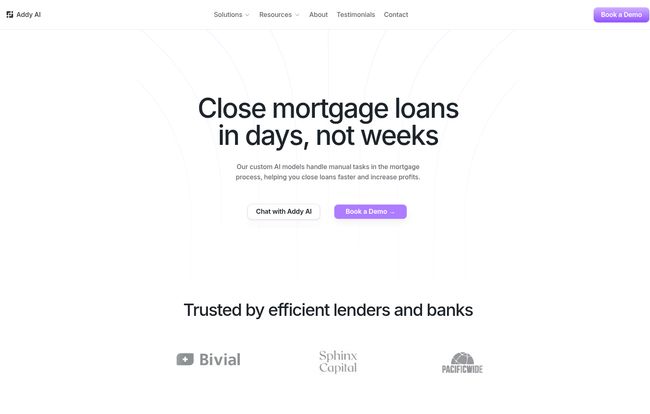

So, when another "game-changing AI tool" pops up, my first reaction is usually a healthy dose of skepticism. We've seen a lot of shiny objects that promise the world but just add another login to our already long list. But then I stumbled upon Addy AI, and I have to admit, my curiosity was piqued. Their headline isn't shy: "Close mortgage loans in hours, not weeks." That's a bold claim. So I decided to dig in and see if it's just marketing fluff or if there's some real fire behind that smoke.

So What Is Addy AI, Really?

In a nutshell, Addy AI is an AI email assistant built specifically for mortgage lenders. This isn't some generic ChatGPT wrapper. Think of it less as a robot and more as a highly-trained digital co-pilot sitting next to you. Its main job is to take over the repetitive, soul-crushing parts of the loan origination process, particularly the communication side. It drafts your emails, learns your personal style—whether you're a formal, just-the-facts kind of person or more of a friendly, first-name-basis professional—and helps you stay on top of every single loan file, 24/7.

It's designed to be the assistant you wish you had, one that never needs a coffee break and can instantly recall the details of every client conversation.

The Features That Actually Matter for Lenders

A tool is only as good as its features, right? Here’s where Addy AI starts to stand out from the crowd.

Beyond Templates: AI-Powered Email Drafting

We've all used email templates. They’re fine, but they often feel… well, robotic. Addy AI goes a step further. It analyzes the context of an email thread and drafts replies that make sense. But the real magic is that it can be trained to learn your voice. Over time, its suggestions start to sound less like a machine and more like you. This is huge. It means you can maintain that personal touch and client rapport without spending hours typing.

Slaying the Paper Dragon with Data Extraction

Picture this: a borrower sends you a W-2, a pay stub, and a bank statement. Instead of manually squinting at PDFs and typing numbers into your system, Addy AI can scan these documents and extract the key data points in seconds. This isn't just about saving a few minutes here and there. Multiply that by dozens of loans, and you're reclaiming a massive chunk of your workweek. Time you could spend building relationships or, you know, having a life.

Your Own Custom AI Mortgage Lending Chatbot

This is probably the most impressive feature, especially for teams on the Enterprise plan. You can train a custom AI model on your own internal documents, product guidelines, and even complex regulations from sources like Fannie Mae and Freddie Mac. Suddenly, you have a chatbot that can answer nuanced questions for your team or even assist clients with a level of accuracy that's specific to your business. It's a huge step toward genuine loan origination automation.

Visit Addy AI

Playing Nice with Your CRM

A new tool that doesn’t integrate with your existing workflow is a non-starter. Addy AI gets this. It’s built to integrate with your CRM, ensuring that all this smart communication and data extraction doesn't live in a silo. This seamless flow of information is critical for maintaining a single source of truth for each client and loan file.

The Real-World Impact: Does It Actually Make You Faster?

Claims like "90% faster loan origination" are easy to throw around. But what does that mean in practice? I found a quote from the CEO of First Capital that resonated:

It's an order of times faster. It really supercharges what an LO can do. They can become these loan originating superheroes.

That hits the nail on the head. This isn't about replacing loan officers. It's about giving them superpowers. It’s about automating the manual drudgery so you can focus on the parts of the job that require a human touch: advising clients, solving complex problems, and navigating the emotional journey of homebuying. If the AI handles the follow-ups and data entry, you're free to be the hero.

Let's Talk Money: Addy AI Pricing

Alright, the all-important question: what's this going to cost me? The pricing structure is refreshingly transparent and has a few different tiers.

- Free Plan: For $0/month, you get a taste of the action. It includes 3 personalized emails per day powered by GPT-3.5 and some basic features. It's a perfect way to test the waters without commitment.

- Unlimited Plan: This is the sweet spot for most solo LOs or small teams, in my opinion. For $7.60 per month (when billed annually), you get unlimited email generations, it learns your writing style, can summarize attachments, and works in all major languages. For less than the price of two fancy coffees, that's a pretty compelling value prop.

- Enterprise Plan: This is the "all-in" package for serious teams and brokerages. You'll have to contact them for custom pricing, but it unlocks the most powerful features: GPT-4, the ability to train custom models on your company's data, and a shared team knowledge base.

Honestly, the pricing seems more than fair. If the Unlimited plan saves you just one hour of work a month, it's already paid for itself several times over.

The Good, The Bad, and The AI-Powered

The Upsides: More Than Just Speed

The main benefits are obvious: you save a ton of time, your efficiency goes through the roof, and clients are happier because they get faster, more consistent communication. It helps you scale your capacity without necessarily scaling your headcount. You can handle more loans without feeling like you're drowning.

The Hurdles: What to Expect

Let's not pretend it's all unicorn and rainbows. First, there's a setup process. Training the AI to learn your style or building a custom chatbot takes some initial effort. It's not a magic wand you wave. Second, you are placing trust in an AI to be accurate. While the tech is impressive, you'll still want to supervise it, especially in the beginning. This is a tool to assist, not to abdicate responsibility.

My Final Verdict: Is Addy AI Worth It for Mortgage Pros?

So, do I think Addy AI is the real deal? Yeah, I do. For the mortgage professional feeling overwhelmed by the daily grind of emails and admin tasks, this tool feels less like a gimmick and more like a genuine lifeline. It's a targeted solution for a very specific set of industry pain points.

If you're a tech-forward loan officer, a small brokerage looking for a competitive edge, or a large lender wanting to standardize excellence, Addy AI is absolutely worth a serious look. The free plan makes it a no-brainer to at least try. If you're completely tech-averse or have a process that's just too unique for words, maybe it's not for you. But for everyone else in the trenches of the mortgage world, this could be the tool that finally lets you put down the coffee, get out of the office on time, and focus on what you do best: closing loans.

Frequently Asked Questions about Addy AI

Can I train Addy AI on my specific loan products?

Yes, with the Enterprise plan, you can train a custom AI model on your company’s specific guidelines, product matrices, and internal knowledge base, making its responses highly relevant to your business.

How secure is my client's data with Addy AI?

This is a critical question. Addy AI states on their site that their platform is private, secure, and they are Google Security Certified. As with any third-party tool, you should still do your own due diligence, but they seem to be taking security seriously.

Is it hard to set up?

There will be an initial learning curve, as with any new software. The basic email features are quite straightforward, but getting the most out of the custom training on the Enterprise plan will require some initial time investment to get it dialed in perfectly.

Can I cancel my subscription at any time?

Yes, according to their FAQ page, you can cancel your subscription at any time. This is pretty standard and great for flexibility.

Does it work with any email provider?

Addy AI is typically delivered as a browser extension, meaning it integrates with popular web-based email clients like Gmail and Outlook on the web. It's designed to work where you work.

Is there a limit on the number of emails Addy can write per day?

The Free plan is limited to 3 emails per day, which is enough for a trial run. The Unlimited and Enterprise plans offer unlimited email generations, so you don't have to worry about hitting a cap.

Conclusion

At the end of the day, the mortgage industry is about people. But the processes that support it are often clunky, outdated, and incredibly time-consuming. Tools like Addy AI represent a smart way forward—using technology not to replace the human element, but to enhance it. By automating the grunt work, it frees up the most valuable resource any loan officer has: their time. And more time means more focus on clients, more strategic thinking, and ultimately, more closed loans. It might just be the superhero sidekick we've been waiting for.