I’ve been in this SEO and traffic game for a long time. You see trends come and go. You see tools rise like a rocket and then, sometimes, just… disappear. It's the nature of the beast. One minute you're excited about a new platform that promises to solve all your problems, the next you're staring at a 404 page, wondering what went wrong.

Which brings me to AccelBooks. A little while back, I was digging into the burgeoning world of embedded finance. It’s a hot topic, right? The idea that any SaaS platform can become a fintech company by integrating financial services directly into their product. It’s about offering banking, lending, and accounting features right inside your app, making your product stickier and opening up new revenue streams. As I was going down this rabbit hole, I came across a name that sounded incredibly promising: AccelBooks.

The pitch was perfect. It was everything a modern SaaS founder could want.

The Dream of Effortless Embedded Accounting

Building out financial features from scratch is a nightmare. I’ve seen teams burn months, even years, trying to build a reliable general ledger, manage transaction data from multiple sources, and create intuitive financial reports. It's a massive technical hurdle and a huge distraction from your core business.

Platforms that offer this as-a-service are, frankly, a godsend. They do the heavy lifting so you can focus on your customers. AccelBooks seemed to be one of these heroes. It was positioned as an embeddable accounting software solution, complete with the APIs and UI components needed to get a fully-fledged, ledger-based financial product off the ground, fast.

A Swiss Army Knife for Your Financial Stack

From what I gathered, AccelBooks wasn’t just a simple API. It was a whole toolkit. It offered a configurable general ledger, which is the backbone of any real accounting system. It had a feature called Data Connection, designed to unify all those messy data sources we all deal with—payments from Stripe, banking from Plaid, payroll, even inventory. Getting all that data to talk to each other is half the battle, and they were offering to solve it.

You could essentially white-label their entire accounting suite and embed it directly into your own platform. For a vertical SaaS serving, say, plumbers or freelance designers, this is huge. You could offer your users a seamless accounting experience without ever sending them to an external site like QuickBooks or Xero. That’s powerful stuff.

The AI Magic I Was Genuinely Excited About

But here's the bit that really got my attention. It was supposedly powered by LLMs—Large Language Models. You know, the same tech behind ChatGPT that's changing everything. AccelBooks was using it for things like auto-categorization of transactions. Anyone who’s ever spent a weekend manually sorting business expenses knows what a game-changer that is.

They even boasted a custom report builder that used this AI to let users ask for financial data in plain English. Imagine your customer just typing, “Show me my profit margin for last quarter, excluding one-time expenses.” That’s not just a feature; it’s a killer app. It felt like the future.

The Reality Check: A Digital Ghost Town

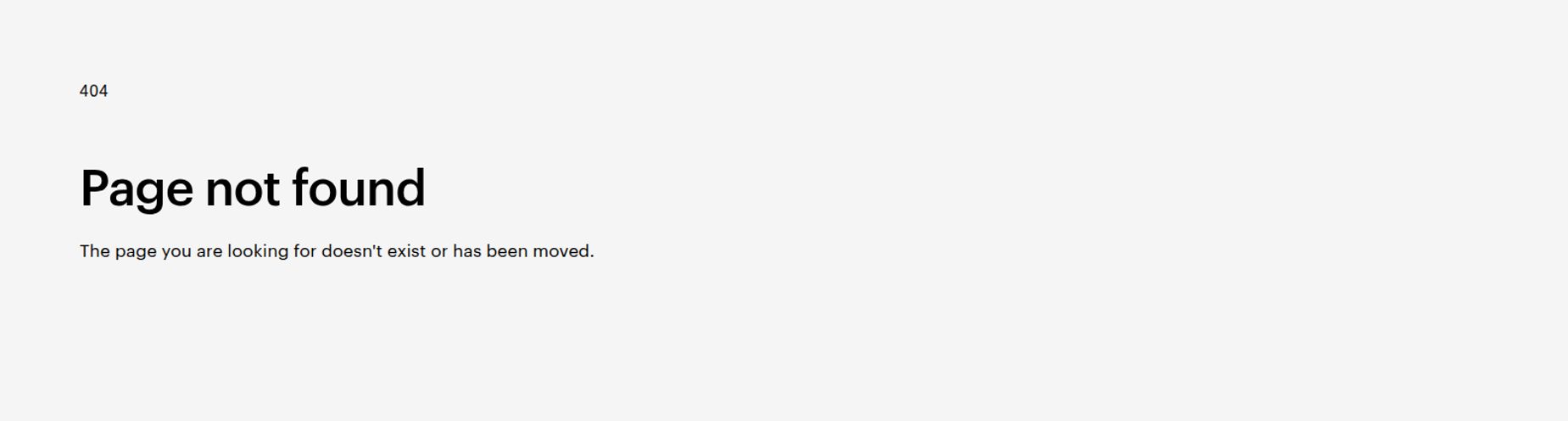

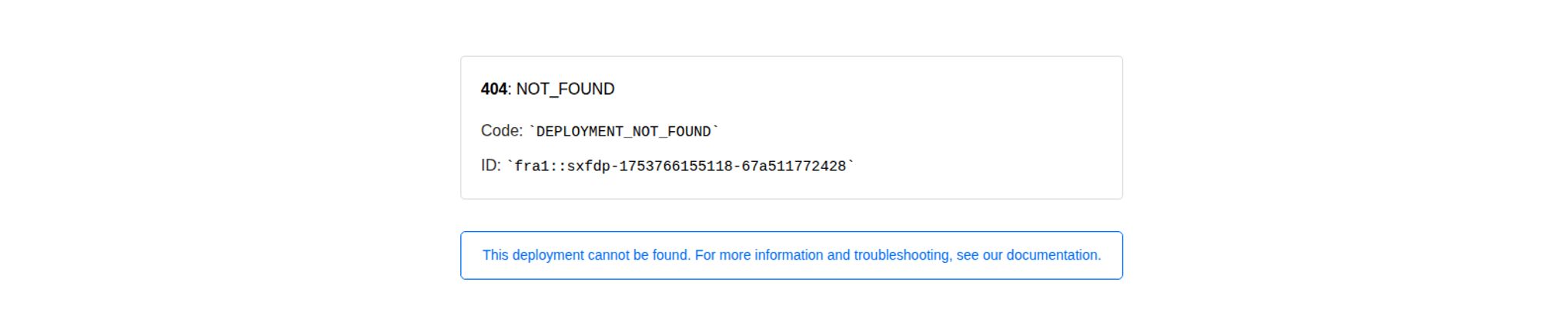

So, naturally, I went to check them out. I had my credit card practically out, ready to see a demo, look at pricing, anything. I typed in the URL I had, clicked enter, and was met with… this.

Visit AccelBooks

A cold, impersonal “404 NOT_FOUND” error. Code: `DEPLOYMENT_NOT_FOUND`.

It’s the digital equivalent of showing up to a grand opening and finding a vacant lot. All that promise, all that potential, and the lights are off. Nobody’s home. There’s a particular kind of irony here, because one of the potential downsides listed for the platform was a “Reliance on AccelBooks' infrastructure and APIs.” Well, you can’t rely on infrastructure that doesn’t exist.

So, What Actually Happened to AccelBooks?

This is where we leave the world of facts and enter the realm of educated speculation. When a promising startup just vanishes like this, it’s usually for one of a few reasons. I've seen it all before.

The Startup Graveyard Theory

The most common story. The startup world is brutal. According to some studies from folks like Startup Genome, the failure rate for startups is incredibly high. It’s possible AccelBooks just couldn't secure their next round of funding or failed to find a sustainable product-market fit before the runway ran out. It happens to the best of them. A great idea isn't always enough.

The "Acqui-hire" Possibility

Another strong possibility is that they were acqui-hired. This is when a larger company buys a startup not for its product or customers, but for its talented team. A big player in the fintech space—think Intuit, Plaid, or even a major bank—might have seen the team's expertise in building LLM-powered accounting tools and made them an offer they couldn’t refuse. In these scenarios, the original product is often shut down as the team gets integrated into the mothership.

The Elusive Pricing Model

I could never find any public pricing information for AccelBooks. This is often a red flag for me. It suggests they might have been struggling to figure out their business model. Were they targeting small startups or enterprise clients? Was it a usage-based model or a flat-rate subscription? This indecision can be fatal in the early stages.

Lessons Learned from a Phantom Platform

The story of AccelBooks, whatever it may be, is a cautionary tale for any of us who rely on third-party tech to run our businesses. It highlights the inherent dependency risk we take on. When you build a core part of your product on someone else's platform, you are betting on their survival as much as your own.

It’s a reminder to do your due diligence. Look for companies with transparent pricing, a clear track record, and a strong community or customer base. Are they well-funded? Who are their investors? It's not just about how good the tech is today, but how confident you are that it will still be around tomorrow.

The dream of embedded accounting is still very much alive, though. There are other players in the space, like Codat and Plaid, who are tackling this from different angles. But I’ll always have a little bit of wonder about AccelBooks. It was a great idea, a glimpse into a more integrated and intelligent future for business software. It’s a shame it seems to have become another ghost in the machine.

Frequently Asked Questions (FAQ)

- What was AccelBooks?

- AccelBooks was a platform designed to let businesses embed white-label accounting software directly into their own applications. It provided the APIs, UI components, and infrastructure to build ledger-based financial products, aiming to save companies significant engineering time.

- What were the key features of AccelBooks?

- Its main features included an embeddable and configurable general ledger, data connection to unify various financial sources (banking, payments, payroll), and advanced tools powered by Large Language Models (LLMs) for automatic transaction categorization and a natural language report builder.

- Is AccelBooks still active?

- Based on the `DEPLOYMENT_NOT_FOUND` error on its website, it appears AccelBooks is no longer active or publicly available. It seems to be a defunct project.

- Why is embedded accounting important for SaaS?

- Embedded accounting allows SaaS companies to offer financial management tools directly within their platform. This increases user engagement and retention (stickiness), creates new revenue opportunities, and provides a more seamless user experience by keeping users within a single ecosystem.

- What are the risks of using a third-party API platform?

- The primary risk is dependency. If the third-party platform shuts down (like AccelBooks seems to have), experiences extended downtime, or makes unfavorable changes to its pricing or features, it can directly and severely impact your own product and business operations.

- Were there any competitors to AccelBooks?

- Yes, the embedded finance and accounting API space has several players. Companies like Codat, Plaid, and Spade offer various tools for financial data aggregation and integration, though AccelBooks' specific all-in-one, LLM-powered approach was quite unique.

References and Sources

- Startup Genome - Global startup ecosystem research: https://www.startupgenome.com/

- Codat - An example of a universal API for small business data: https://codat.io/

- Plaid - A popular financial data network: https://plaid.com/